Starting a business in Vermont? You’re in luck—this small but mighty state offers a great environment for entrepreneurs. Whether you’re setting up a maple syrup business, an eco-friendly startup, or anything in between, forming an LLC is a smart way to protect your personal assets while keeping your business structure simple. But here’s the deal: finding the best LLC services in Vermont can feel like navigating a winding country road without a map. That’s where this guide comes in!

I’ve rounded up everything you need to know to make your LLC formation smooth, stress-free, and even a little fun. Let’s explore the top LLC services that can help you get your Vermont business off to a great start!

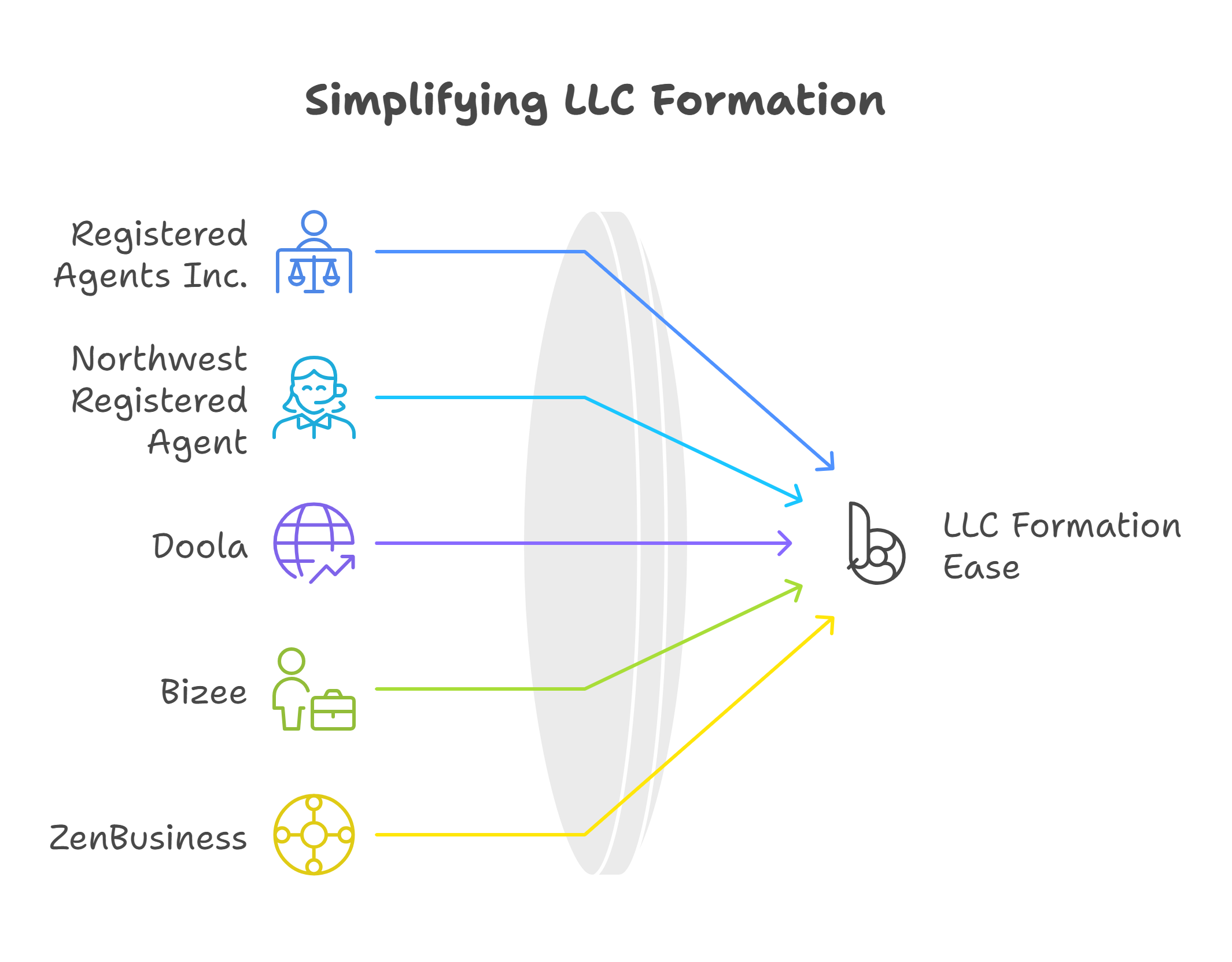

Top 5 Best LLC Services in Vermont

Here’s a unique and friendly list of the Top 5 Best LLC Services in Vermont to help you form your LLC with ease:

1. Registered Agents Inc. – The All-in-One Pro

When it comes to forming an LLC in Vermont, Registered Agents Inc. is the ultimate powerhouse. For just $100 plus state fees, they’ll handle your business formation and throw in a full year of registered agent services—for free! Plus, their additional services, like a domain name, SSL, and a business email, come at ridiculously affordable prices. They make it easy for you to hit the ground running without breaking the bank. If you’re looking for premium services with clear pricing, this is the one to beat!

2. Northwest Registered Agent – The Customer Service Champ

If you want hands-on support and straightforward pricing, Northwest Registered Agent is a stellar choice. At $39 plus state fees, they not only form your LLC but also include a free year of registered agent services. Known for their stellar customer service, you’ll get personalized assistance every step of the way—no automated robots here! Their transparency and “privacy by default” approach make them a favorite for Vermont entrepreneurs.

3. Doola – The Global Entrepreneur’s Sidekick

Want a service that goes beyond just forming an LLC? Doola has you covered. They specialize in helping entrepreneurs (especially non-US residents) form and manage their businesses seamlessly. Starting at $297 per year plus state fees, they include LLC formation, an EIN, registered agent services, and even a virtual business address. Their higher-tier packages cover compliance, tax filings, and even bookkeeping—perfect if you want a one-stop shop to handle it all.

4. Bizee (formerly Incfile) – The Budget-Friendly Starter

If you’re on a tight budget but still want a quality service, Bizee is your go-to. Their Basic package is absolutely free—yes, $0—plus state fees, and it includes business formation, a free year of registered agent services, and even compliance alerts. Their Standard and Premium packages offer added perks like EIN acquisition, an operating agreement, and expedited filing. They’re a fantastic choice for those looking for flexibility and value.

5. ZenBusiness – Affordable With All the Extras

ZenBusiness is perfect for small business owners who want a bit of everything. Their Starter package begins at $0 plus state fees, offering filing services and a 100% accuracy guarantee. Step up to the Pro package ($199/year) for extras like an EIN and rush filing, or go all-in with the Premium package ($299/year) for a business website, email, and more. While their support could use a little polish, their service options make them a strong contender for Vermont entrepreneurs.

Final Thoughts: Vermont is a fantastic state for forming an LLC, and these five services make the process simple, stress-free, and affordable. Whether you prioritize top-tier support, robust features, or budget-friendly pricing, there’s an option here for every kind of entrepreneur. Which one will you choose? 😊

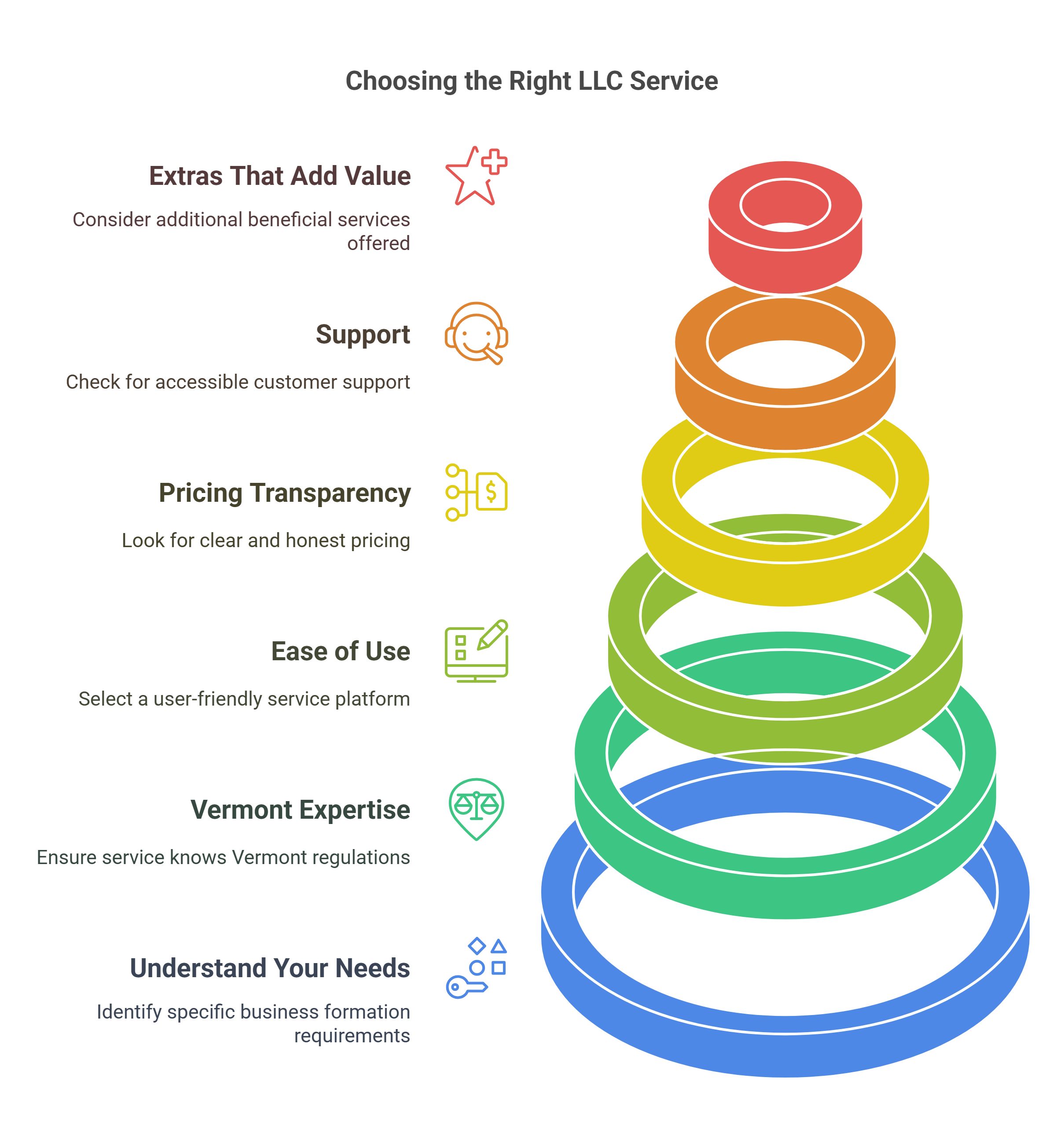

How to Choose Best LLC Service In Vermont

Forming an LLC in Vermont is a big step toward building your business dreams, and choosing the right LLC service can make the whole process smooth and stress-free. But with so many options out there, it’s easy to feel overwhelmed.

Don’t worry—I’ve got you covered with a step-by-step guide to help you pick the best LLC service for your Vermont business.

1. Understand Your Needs First

Before diving into the search, think about what you really need from an LLC service. Are you just looking for basic filing services, or do you want extras like registered agent services, operating agreement templates, or help with getting an EIN? Knowing your priorities will help narrow down your options.

2. Check for Vermont Expertise

Not all LLC services are equally familiar with Vermont’s requirements. Look for one that knows the ins and outs of Vermont’s state-specific rules, like filing with the Secretary of State and staying compliant with local laws. Bonus points if they offer help with Vermont’s annual report requirements and ongoing compliance.

3. Ease of Use

Starting an LLC shouldn’t feel like solving a complex puzzle. The best LLC service will have a user-friendly process, clear instructions, and an intuitive online platform. If you find yourself scratching your head over unclear steps, that’s a red flag.

4. Pricing Transparency

Nobody likes surprise fees! Make sure the service you choose is upfront about their costs. Check whether the price includes the Vermont LLC filing fee or if that’s extra. Look for any recurring charges for services like registered agent support, annual report filing, or compliance monitoring.

5. Look for Support

Sometimes, questions pop up—especially if it’s your first time forming an LLC. A good LLC service will have responsive customer support to guide you through the process. Whether it’s live chat, email, or phone support, make sure help is just a click or call away.

6. Extras That Add Value

Some services go beyond filing and offer tools like an operating agreement template, business address services, or tax consultation. Consider these extras if they’re important for your business. While these perks may cost a little more, they can save you a lot of hassle in the long run.

7. Read Reviews (But Stay Skeptical!)

Reviews are a goldmine of information, but take them with a pinch of salt. Look for consistent feedback about the service’s efficiency, support quality, and reliability. If something feels too good—or too bad—to be true, dig a little deeper to verify.

- Speed of Service

Vermont’s LLC processing times can vary depending on how you file. If you’re in a hurry to get your business off the ground, choose a service that offers expedited filing options. However, if time isn’t a major concern, standard filing might work just fine.

9. Registered Agent Services

Every Vermont LLC needs a registered agent. Some LLC services include this for free for the first year, while others charge separately. Ensure the service offers reliable registered agent support since it’s a critical part of maintaining your LLC’s good standing.

10. Reputation and Longevity

Trust is key when picking an LLC service. Look for one with a solid reputation and experience in the business. While newer services can be tempting with lower prices, established providers often come with the benefit of reliability and proven results.

My two cents!

Choosing the best LLC service in Vermont doesn’t have to be daunting. By focusing on what matters most—like ease of use, pricing transparency, and Vermont expertise—you can find a service that aligns perfectly with your business goals. Starting your LLC is an exciting milestone, and the right service will help you get it done efficiently, so you can focus on growing your dream into reality.

Best of luck with your Vermont LLC journey! 🚀

Reviews of Best LLC Services in Vermont

Here are unique and friendly reviews of Best LLC Services in Vermont. I have listed the top companies with pros and cons so, you can make an informed decision.

1. Registered Agents Inc.

Starting an LLC in Vermont? It’s a journey that can feel overwhelming, but Registered Agents Inc. is here to simplify the process. Known for their straightforward pricing, excellent service, and helpful extras, Registered Agents Inc. has built a reputation as one of the best LLC services in Vermont. Let’s break down why they’re worth considering, along with some areas they could improve.

Pros of Registered Agents Inc.

- Affordable Business Formation: At $100 plus state fees, their LLC formation services are a great value. The bonus? One year of registered agent services is included at no extra charge.

- Transparent Pricing: No surprise fees or hidden costs. You know exactly what you’re paying for.

- Reliable Registered Agent Service: Their registered agent service ($200 annually after the first free year) is comprehensive, with compliance reminders and secure handling of your documents.

- Business Essentials at Low Prices: Need a domain with SSL, a business email, or a phone number? They’ve got you covered for just $5 per year or $5 per month for each service.

- Great Customer Support: Their team is responsive, knowledgeable, and ready to help with Vermont-specific compliance questions.

- Focus on Compliance: From annual reports to legal document handling, they help Vermont LLC owners stay on track with state requirements.

Cons of Registered Agents Inc.

- Higher Registered Agent Renewal Fee: While the first year is free, $200 per year might feel steep compared to some competitors offering lower renewal rates.

- No Advanced Customization Options: Their formation packages are straightforward but lack advanced features like bundled expedited filing services.

- Not Ideal for DIY Enthusiasts: If you prefer handling filings yourself and just need minimal guidance, their full-service approach might be more than you need.

A Vermont-Friendly Service

Vermont LLC owners appreciate simplicity and affordability, and Registered Agents Inc. nails both. Their combination of transparent pricing and hands-on support ensures you don’t just start your business—you run it smoothly, year after year.

Their compliance-first approach also stands out. Vermont requires LLCs to file annual reports by March 15th, and they’ll make sure you’re on top of that. No need to scramble for deadlines or worry about missed filings—they’ll send reminders and keep your business in good standing.

Why Registered Agents Inc. is One of the Best LLC Services in Vermont

At the end of the day, Registered Agents Inc. stands out for its straightforward pricing, reliable services, and customer-first approach. Whether it’s forming your LLC, keeping your Vermont business compliant, or offering affordable extras like a professional website and business email, they’re a one-stop shop for entrepreneurs.

Final Verdict

For Vermont LLC owners, Registered Agents Inc. strikes a balance between affordability and reliability. While the registered agent renewal fee might be higher than some competitors, their value-packed services and excellent support make them a strong contender. So, if you’re ready to form your LLC with confidence, give Registered Agents Inc. a closer look—they just might be the partner your business needs.

Start Your Business Today with Registered Agents Inc.

2. Northwest Registered Agent

If you’re looking for one of the best LLC services in Vermont, let me introduce you to Northwest Registered Agent. Known for their transparency and no-nonsense approach, Northwest is like that dependable friend who always shows up on time and never forgets to bring snacks. Forming a Vermont LLC is a big step, and Northwest makes it surprisingly smooth, with services that genuinely stand out.

What Makes Northwest Registered Agent Special?

Here’s why they’ve earned a reputation as one of the best LLC services in Vermont:

- Transparent Pricing

Unlike many providers that lure you in with hidden upsells, Northwest keeps it simple. They charge just $39 (plus the $125 Vermont state filing fee) for their LLC formation service. No sneaky costs. No confusing fine print. It’s a refreshing change in a world full of surprises. - Free Registered Agent Services for the First Year

When you form your Vermont LLC with Northwest, they throw in a year of registered agent service for free. After that, it’s just $125 annually, which is still a fantastic deal considering the peace of mind it brings. Their registered agent service ensures you never miss important state documents or legal notices. - Top-Notch Customer Support

Northwest is famous for their “Corporate Guides.” These are real humans (not bots!) who are knowledgeable, helpful, and easy to reach. Whether you have questions about Vermont LLC requirements or just need advice, their support team is ready to help. - Privacy Protection

Starting a business often means sharing a lot of personal information, but Northwest values your privacy. They go the extra mile to shield your details, offering features like using their business address on public filings instead of your home address.

Why Choose Northwest Registered Agent for a Vermont LLC?

Forming an LLC in Vermont comes with its own unique set of rules, but Northwest knows them inside out. They handle the heavy lifting—from filing your Articles of Organization to ensuring compliance with Vermont’s regulations. Their emphasis on quality service, along with their dedication to transparency, makes them an excellent choice.

Plus, if you’re someone who values reliability and straightforward pricing, Northwest feels like a breath of fresh Vermont mountain air.

A Few Downsides (Because No One’s Perfect)

While Northwest has a lot going for them, it’s worth noting:

- They’re not the cheapest option. If price is your main priority, there are some free LLC formation services (though they tend to come with strings attached).

- Their focus on simplicity means fewer add-ons, like website-building tools or business credit assistance. But hey, if you’re all about forming your Vermont LLC without fluff, this won’t bother you.

Final Thoughts

Northwest Registered Agent is hands down one of the best LLC services in Vermont for entrepreneurs who value transparency, privacy, and stellar customer service. They take the stress out of forming an LLC so you can focus on what really matters: building your dream business in the Green Mountain State.

Whether you’re starting a maple syrup business, opening a boutique, or launching a tech startup, Northwest has your back. With their honest pricing, privacy-first approach, and a team of friendly experts, they’re an excellent partner to help you get your Vermont LLC off the ground.

Start Vermont LLC with Northwest Registered Agent

3. Doola

When it comes to forming a Vermont LLC, Doola is hands-down one of the best services out there. Whether you’re a U.S. resident looking to avoid the usual tax headaches or an international entrepreneur venturing into the U.S. market, Doola makes the whole process feel like a breeze. They’re reliable, efficient, and most importantly, they really “get” what entrepreneurs need. But, like anything, they’re not perfect! Let’s take a closer look at their pros and cons to help you decide if they’re the right fit for your Vermont LLC.

Why Doola Stands Out for Vermont LLCs

The Pros

- Perfect for International Entrepreneurs:

Doola specializes in helping non-U.S. residents set up LLCs. They make tricky things—like obtaining an EIN without an SSN and navigating U.S. compliance laws—easy. - Tax Filing Made Simple:

Vermont LLC owners need to file annual reports and stay on top of state and federal tax requirements. Doola’s Total Compliance packages handle these filings, leaving you worry-free. - All-in-One Packages:

With options ranging from basic LLC formation to full compliance and bookkeeping services, Doola has packages for everyone—whether you’re a DIYer or someone who wants everything taken care of. - Registered Agent Services Included:

Vermont requires a registered agent for LLCs, and Doola provides this for free during your first year. They’ll manage all legal and state correspondence on your behalf. - Hassle-Free EIN Acquisition:

Getting an EIN is crucial for opening a U.S. business bank account, and Doola takes care of this for both U.S. residents and international entrepreneurs. - Great for Busy Entrepreneurs:

If you’re juggling multiple responsibilities, Doola’s services save you time and effort. Their bookkeeping add-ons are especially helpful if you hate dealing with numbers. - Friendly Customer Support:

Doola’s support team is knowledgeable and responsive, which is essential for first-time business owners or those navigating U.S. systems from abroad.

The Cons

- Premium Pricing for High-End Services:

While the Starter Package is reasonably priced at $297/year (plus state fees), the Total Compliance ($1,999/year) and Total Compliance Max ($2,999/year) packages can feel expensive, especially for small startups or entrepreneurs on a tight budget. - Not the Fastest Option:

While Doola handles the paperwork efficiently, they don’t prioritize expedited filing like some competitors. If you’re in a rush to get your Vermont LLC approved, this could be a drawback. - No Pay-As-You-Go Options:

Doola’s services are subscription-based, meaning you’ll pay annually. If you’re just looking for one-time LLC formation without ongoing services, their pricing structure may not suit you. - Limited DIY Tools:

Entrepreneurs who prefer a DIY approach might find Doola’s service options too all-inclusive. There’s no barebones package for those who only need formation assistance without extras like registered agent services or compliance support.

Doola’s Service Packages for Vermont LLCs

Doola offers three main packages tailored to fit your business needs:

- Starter Package – $297/year + state fees:

- Includes LLC formation, EIN acquisition, registered agent service (free for the first year), and a virtual business address.

- Total Compliance Package – $1,999/year + state fees:

- Everything in the Starter Package plus BOI filing, annual state tax filings, CPA consultations, and business IRS tax filings.

- Total Compliance Max – $2,999/year + state fees:

- Includes all Total Compliance services plus human-powered bookkeeping services. Perfect for entrepreneurs who want their financials handled by pros.

Who Is Doola Best For?

- International Entrepreneurs: If you’re outside the U.S. and need help with Vermont LLC formation and compliance, Doola makes the process seamless.

- Tax-Phobic Entrepreneurs: Their compliance packages are a lifesaver for business owners who want someone else to handle all tax filings and reports.

- Busy Professionals: If you’d rather focus on growing your business than managing the paperwork, Doola’s done-for-you services are worth the investment.

Final Thoughts: Should You Choose Doola for Your Vermont LLC?

If you’re an entrepreneur looking for a reliable, all-in-one LLC formation service in Vermont, Doola is an excellent choice. They’re especially great for international entrepreneurs who want to tap into the U.S. market and avoid tax or compliance headaches. Their packages are packed with value, and their support team is always ready to lend a helping hand.

That said, if you’re on a tight budget or just need basic LLC formation without the bells and whistles, Doola might feel a bit pricey. But for those who value convenience, expert guidance, and tax filing peace of mind, they’re worth every penny.

So, whether you’re in Vermont or halfway around the globe, Doola has the tools and expertise to help you build your dream business. Say goodbye to the paperwork stress and hello to hassle-free entrepreneurship!

Start an LLC with Doola and get 10 percent exclusive discount: DOOLAREHAN10

4. Bizee

If you’re setting up a Vermont LLC, Bizee (formerly known as Incfile) might just become your new best friend. Why? Well, they’ve been in the business formation game for a while and are known for keeping things straightforward and affordable. Let’s dig into what they offer, the pros and cons, and whether it’s a good fit for your Vermont LLC.

The Basics of Vermont LLC Formation

First things first, Vermont has a $125 filing fee for LLC formation. That’s a state cost you’ll need to cover no matter which service you use. Bizee helps you handle all the paperwork, file your Articles of Organization, and set you up to operate your LLC legally in Vermont. Plus, they throw in some nice extras, especially with their free (yes, free!) package.

Bizee’s Pricing & Packages

Here’s the breakdown of what Bizee offers for Vermont LLC formation:

- Basic Package: $0 + State Fees

- Preparation and filing of your Articles of Organization.

- Name availability search to make sure your dream LLC name is up for grabs.

- A full year of free registered agent services (you’ll pay $119 annually after that).

- Compliance alerts so you don’t miss important state deadlines.

- Lifetime access to their online dashboard to manage your LLC docs.

- A free business tax consultation session.

- Honestly, if you’re on a tight budget, this package is unbeatable since it covers the basics with no upfront cost (aside from Vermont’s $125 fee).

- Standard Package: $199 + State Fees

- Everything in Basic.

- EIN acquisition (a must if you want to open a business bank account or hire employees).

- Customized operating agreement and banking resolution.

- IRS Form 2553 filing if you want to elect S-Corp status.

- Lifetime company alerts and assistance with opening a business bank account.

- This package is ideal if you want a little more hand-holding and essential documents ready to go.

- Premium Package: $299 + State Fees

- Everything in Standard.

- Expedited filing service for faster LLC approval.

- Access to a library of business contract templates.

- Domain name and business email setup for that professional touch.

- If you’re starting a Vermont LLC and want a fully polished, fast-tracked experience, Premium is worth the splurge.

Why Choose Bizee for Your Vermont LLC?

Here’s what makes Bizee stand out:

- Budget-Friendly: Their Basic Package is perfect for DIY-ers who want to save cash but still have a pro handle the formation process.

- Free Registered Agent Service: A full year of registered agent service is included in all packages. This is a big deal since Vermont requires LLCs to maintain one.

- User-Friendly Platform: Their dashboard keeps your LLC documents organized and easily accessible.

- Extras in Higher Tiers: If you need an EIN, operating agreement, or expedited service, their Standard and Premium packages cover you.

The Downsides

While Bizee has a lot going for it, there are a couple of things to keep in mind:

- Ongoing Costs: After the first year, registered agent services cost $119 annually. While that’s not bad compared to competitors, it’s something to budget for.

- Add-Ons Can Add Up: If you need services outside of the packages (like extra compliance help), costs can stack up quickly.

Is Bizee Right for You?

If you’re forming a Vermont LLC and looking for an affordable and reliable service, Bizee is a fantastic option. Their $0 Basic Package gives you everything you need to get started without breaking the bank, and their Standard and Premium tiers are great for those who want more support. Plus, their first-year registered agent service makes compliance easy, which is especially handy for new business owners.

In short, Bizee simplifies the process of starting your Vermont LLC so you can spend less time stressing over paperwork and more time building your dream business. For that alone, it’s worth considering!

Get Bizee to Help for Vermont LLC

5. Zenbusiness

So, you’ve decided to start an LLC in the lush, green state of Vermont—awesome choice! Vermont is known for its business-friendly environment, and with ZenBusiness in the picture, getting your LLC off the ground might seem like a breeze. But is it really? Let’s dive into the nitty-gritty and find out if ZenBusiness is your go-to partner for your Vermont LLC.

Why Choose ZenBusiness?

ZenBusiness has been gaining popularity for its affordable LLC formation services, especially for first-time entrepreneurs. If you’re looking for a straightforward way to file your LLC paperwork while sipping a latte in your favorite café, ZenBusiness seems like a solid option. But let’s break down their Vermont-specific offerings to see if they truly deliver.

1. Pricing: What Will It Cost You?

ZenBusiness offers three main packages for LLC formation:

- Starter: $0 (plus Vermont’s $125 filing fee)

- Basic filing service with 100% accuracy guarantee.

- Free optional Worry-Free Compliance for the first year (renews at $199).

- No fancy extras, but if you’re just getting started, it’s a no-frills way to file your LLC.

- Pro: $199 per year (plus Vermont’s filing fee)

- Includes rush filing, an EIN (a must-have for taxes), and an operating agreement template.

- Perfect for someone who wants a bit more hand-holding.

- Premium: $299 per year (plus Vermont’s filing fee)

- Adds domain registration, a website builder, and a business email.

- If you want your Vermont maple syrup LLC to have an online presence, this might be tempting.

The verdict? The Starter package is great if you’re budget-conscious, but the Pro package hits the sweet spot if you want a solid combo of features without overpaying. The Premium package? Only worth it if you’re serious about a website and email right from the start.

2. Ease of Use: It’s as Simple as Pie

ZenBusiness is known for its user-friendly platform, and that reputation holds up in Vermont. From creating an account to submitting your Articles of Organization, the process is intuitive. The dashboard is sleek, and all your documents are stored in one place—no more hunting for that elusive LLC certificate!

The guided steps make it perfect for beginners, and honestly, Vermont LLC filing doesn’t have to be stressful when the system walks you through everything.

3. Customer Support: Hit or Miss?

Here’s where ZenBusiness can be a bit… inconsistent. While their chat and email options are okay, you might find yourself waiting a bit longer than you’d like for a response. Vermont entrepreneurs, take note: if you’re filing close to deadlines or need immediate answers, the slower support might frustrate you.

4. Worry-Free Compliance: Worth It or Not?

ZenBusiness loves promoting its Worry-Free Compliance service, which helps you stay on top of annual reports and state requirements. Vermont LLCs have an annual report fee of $35, and ZenBusiness will remind you to file it—so you don’t forget and risk penalties.

While this service renews at $199/year, it can be a lifesaver if you’re someone who tends to procrastinate. If you’re confident in handling filings yourself, you might skip this and save some cash.

5. Vermont-Specific Benefits

ZenBusiness doesn’t offer any Vermont-exclusive perks, but their general efficiency works well regardless of your state. Vermont’s LLC filing fee is $125, which you’ll pay no matter which service you use. ZenBusiness ensures that your Articles of Organization are filed correctly and keeps things stress-free.

Pros of Using ZenBusiness for a Vermont LLC

✅ Affordable Starter package (literally $0 + state fees!)

✅ Easy-to-use platform with a sleek dashboard

✅ Free registered agent service for the first year (huge bonus)

✅ Worry-Free Compliance for entrepreneurs who need reminders

Cons of Using ZenBusiness for a Vermont LLC

❌ Customer support can be slow at times

❌ Recurring fees for services like registered agent and compliance might catch you off guard

❌ Premium package feels a bit overpriced for what you get

My Verdict: Is ZenBusiness the Best Choice for a Vermont LLC?

ZenBusiness is a strong contender if you’re forming an LLC in Vermont. Their Starter package is unbeatable for budget-conscious entrepreneurs, and their platform makes the whole process feel less intimidating. That said, if you need lightning-fast customer support or dislike annual fees, you might want to explore other options.

For Vermont business owners who love simplicity, ZenBusiness is a great choice. Just keep an eye on those recurring costs so they don’t sneak up on you!

What’s your Vermont LLC going to be about? Whether it’s a maple syrup empire, an eco-friendly coffee shop, or something else entirely,

ZenBusiness can help you get started. Here’s to building your dream business in the Green Mountain State! 🌲

Conclusion: Best LLC Services in Vermont

When it comes to forming an LLC in Vermont, you’ve got plenty of great options to choose from. Whether you’re starting a cozy small business in Burlington or launching an eco-friendly venture in the Green Mountain State, it’s all about finding the service that aligns with your needs. Some prioritize affordability, others shine with comprehensive features like compliance tracking or speedy filings, and then there are those that cater to entrepreneurs seeking premium, all-inclusive packages.

The best LLC service for you will depend on factors like your budget, desired level of support, and any extras you might need, like registered agent services or an operating agreement template. Vermont’s straightforward filing process and affordable state fees make it easy for you to focus on what matters most—bringing your business dreams to life.

At the end of the day, the right service will make the process stress-free and ensure your LLC starts off on the right foot. Vermont’s business-friendly vibe is waiting to welcome you, so choose wisely and get ready to embark on an exciting entrepreneurial journey!

Best LLC Services in Vermont FAQs

Here are the answer to the questions asked by you.

Rehan, Your hatred for LegalZoom seems to growing I cannot find them anywhere on your lists?

Haha, you caught me, didn’t you? I wouldn’t say it’s “hatred” for LegalZoom—it’s more like a very strong preference for better options! Look, LegalZoom has been around forever, and they’re a big name in the industry. But the truth is, I like to focus on services that offer the best value for people starting their LLCs, and LegalZoom just doesn’t make the cut for most of my lists.

Why? Well, they’re pricey, a bit slow, and often upsell services that other providers include in their base packages. It feels like paying steakhouse prices for a drive-thru burger, you know? And don’t even get me started on their support… let’s just say, I’ve seen friendlier and more responsive service elsewhere.

I’m not throwing shade—if LegalZoom works for someone, great! But when I recommend something, I want it to be affordable, efficient, and packed with value. So, yeah, LegalZoom doesn’t show up much on my lists. It’s not personal—it’s business! 😊

Is Registered Agent required for Vermont LLC?

Let’s talk about registered agents and Vermont LLCs in a way that makes it super easy to understand!

Yes, a registered agent is required for your Vermont LLC. Think of the registered agent as your LLC’s official “go-to” person. Their job is to accept important legal and government documents on behalf of your business—kind of like the VIP mailbox for your company. Whether it’s tax notices, lawsuits (hope not!), or annual report reminders, your registered agent is the one keeping everything organized and on track.

Now, here’s the fun part—you have options! You can either:

- Be your own registered agent: If you live in Vermont and don’t mind being available during regular business hours, you can DIY this. But keep in mind, that means no sneaking off for midday hikes in the Green Mountains unless someone’s covering for you.

- Hire a professional registered agent service: This is a stress-free option where a third-party service handles it all. They’ll be available 9-to-5 and keep things private if, say, sensitive documents are delivered (because nobody wants legal papers handed to them in front of a client!).

Bottom line: Having a registered agent isn’t just a box to tick—it’s essential for staying compliant and keeping your LLC in good standing. Vermont takes this seriously, and so should you. 😊

Can I get Vermont LLC For free?

Starting a Vermont LLC for free sounds like a dream, but let me break it down in a way that’s both realistic and easy to follow.

Technically, forming a Vermont LLC isn’t completely free because the state charges a mandatory filing fee of $125 to process your Articles of Organization. This fee is non-negotiable—it’s the price of making your LLC official in Vermont. No matter how many creative hacks or cost-saving tips you try, there’s no way around it.

That said, there are still some ways to keep other costs close to zero! Here’s how you can form a Vermont LLC as inexpensively as possible:

1. Do-It-Yourself Filing

Skip hiring expensive LLC formation services by filing your Articles of Organization yourself. Vermont makes it pretty straightforward to file online through their Corporations Division portal. You’ll need basic info about your business, like your LLC’s name and your registered agent details (which brings me to the next tip!).

2. Be Your Own Registered Agent

In Vermont, every LLC needs a registered agent, but you don’t have to pay someone to do it. You can act as your own registered agent if you’re comfortable having your name and address publicly listed and you’re available during regular business hours. That saves you anywhere from $100 to $300 annually!

3. Skip the Extras

Many formation services or websites will try to upsell you on things like operating agreements, EINs, or fancy compliance services. While these extras can be helpful, they’re not mandatory. You can:

- Create your own operating agreement using free templates online.

- Get an EIN for free directly from the IRS website (takes about 5 minutes!).

- Handle your annual report yourself for just $35 (this is due each year by March 15).

4. Use Free Resources

If you need help understanding the process, there are tons of free guides online (like the ones on my site—shameless plug!) that break everything down step-by-step. No need to pay for advice when you can find it for free.

The Bottom Line

While you can’t completely avoid Vermont’s $125 filing fee, you can definitely cut out unnecessary costs by handling things yourself and taking advantage of free resources. It’s the next best thing to forming your LLC for free—and you’ll feel pretty accomplished doing it on your own! 💪

Is Vermont Good State for LLC?

Vermont might not be the first state that comes to mind when you think about forming an LLC, but it has its charm and quirks! Here’s a friendly dive into what makes Vermont a good (and sometimes not-so-good) state for forming an LLC.

What’s Great About Vermont for an LLC?

- Low Filing Fees: Vermont keeps it reasonable with a $125 filing fee to form an LLC. That’s not rock-bottom, but it’s affordable compared to some pricier states. If you’re keeping a close eye on costs, Vermont won’t give you sticker shock.

- Straightforward Annual Reports: Vermont’s annual report fee is $35, which is quite low. This makes staying compliant and maintaining your LLC much more budget-friendly compared to states with heftier fees.

- Eco-Friendly State Perks: Vermont is big on sustainability. If your LLC is in the eco-friendly, green business space, Vermont might just be the perfect place for you. The state aligns with values like clean energy and environmental responsibility, which could even attract like-minded customers or clients.

- Support for Small Businesses: Vermont is all about community and small business support. There are numerous state programs to help entrepreneurs, and the local business scene is tight-knit and supportive.

What’s Not-So-Great About Vermont for an LLC?

- Higher Taxes: Vermont is not the friendliest when it comes to taxes. The state imposes an 8.5% corporate income tax and an $250 minimum annual business tax, even for LLCs taxed as corporations. If you’re looking for a tax haven, Vermont won’t be it.

- Limited Growth Potential for Some Industries: Vermont is a smaller state with a population of just over 600,000. If your business relies heavily on a large local market, you might find it challenging to scale here. That said, online businesses are less affected by this.

- Strict Environmental Regulations: While Vermont’s focus on sustainability is a plus for eco-conscious entrepreneurs, it can be a headache for businesses in industries like construction, manufacturing, or agriculture. Be ready to navigate stricter-than-average regulations.

- Seasonal Challenges: If your LLC deals with tourism or outdoor services, Vermont’s long winters could be a hurdle. The colder months can slow down foot traffic and reduce demand for some services.

The Verdict on Vermont

Vermont is a fantastic state for LLCs that value sustainability, want a low-cost annual upkeep, and thrive in a supportive small-business ecosystem. However, it’s less appealing if you’re looking for tax advantages or operating in industries that struggle with environmental regulations or seasonal changes.

So, is Vermont a good state for your LLC? If you’re the type who enjoys working amidst scenic landscapes and appreciates a close-knit business community, Vermont might just be your jam. But if taxes or scaling potential are dealbreakers, you might want to look elsewhere.