Thinking about launching your dream business in the Golden State? Good choice! California is home to innovation, opportunity, and a thriving entrepreneurial scene. But before you dive into running your business, you’ll need to set up your legal foundation—and that’s where an LLC comes in.

If you’re wondering How to start an LLC in California, don’t worry—I’ve got you covered. The process might seem overwhelming at first, but it’s actually pretty straightforward once you break it down.

In this guide, I’ll walk you through each step, from choosing a business name to filing paperwork and keeping your LLC compliant. By the time you’re done, you’ll be one step closer to officially launching your California business.

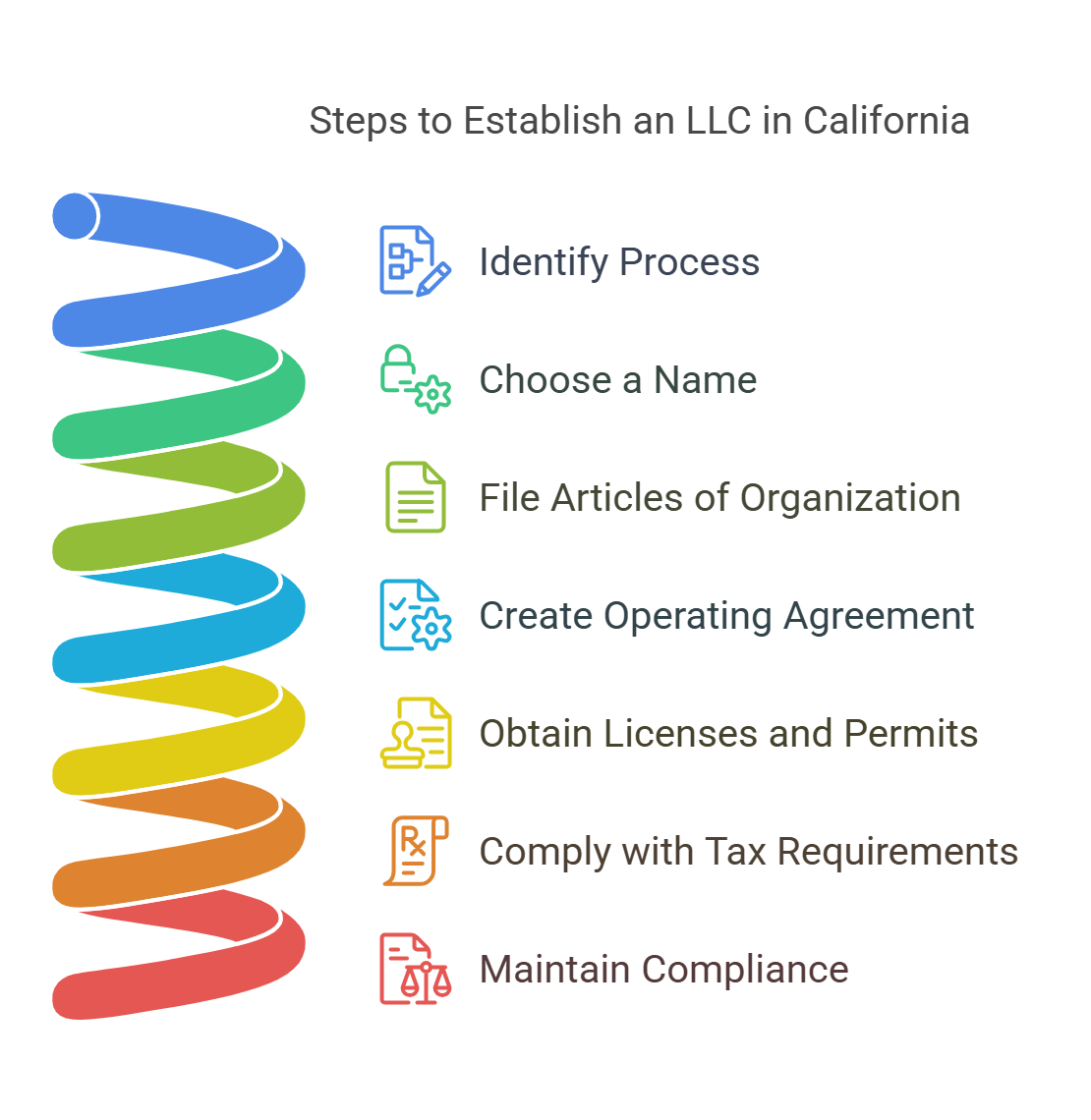

7 Steps to Start an LLC in California

-

Pick a Standout Name – Make sure your LLC name is unique and follows California’s rules. Check availability before you get too attached!

-

Choose a Registered Agent – Someone needs to accept legal documents for your business. It can be you or a service, but they need a real California address (no P.O. boxes!).

-

File the Articles of Organization – This is the paperwork that officially creates your LLC. Submit Form LLC-1 to the state with a $70 fee.

-

Draft an Operating Agreement – Even if it’s just you running the business, California requires an LLC to have one. It lays out how your business will operate.

-

Get an EIN from the IRS – This is your business’s tax ID number. You’ll need it to open a bank account and handle taxes. It’s free and easy to get online! For non-US residents, without ITIN and SSN the Fax is the way to go.

-

Submit Your Initial Statement of Information – File Form LLC-12 within 90 days of forming your LLC. It costs $20, and you’ll need to do this every two years.

-

Pay the California Annual LLC Tax – California charges an $800 minimum tax to LLCs every year, so be ready to send that check to the Franchise Tax Board.

Do It Yourself or Hire a Professional?

Filing your LLC’s Articles of Organization by yourself is possible. However, if you’re worried about making a mistake, I recommend hiring a professional LLC formation service.

Top 3 LLC Formation Services:

- 1. Registered Agents Inc.

💰 $100 + state fees (includes a free registered agent for 1st year) - 2. Northwest Registered Agent

💰 $39 + state fees (includes a free registered agent for 1st year) - 3. Bizee

💰 $0 + state fees (includes a free registered agent for 1st year)

Save time and avoid errors by choosing a professional LLC service!

Don’t want to hire a company? Confident enough to do it yourself? No worries follow the guide till the end and you will be able to form an LLC in California by yourself.

How much does it cost to start an LLC in California?

Starting an LLC in California isn’t the cheapest ride, but it’s definitely worth it if you’re serious about building a business in the Golden State. Here’s what you need to know about the costs:

1. Filing Fee – $70

To officially bring your LLC to life, you need to file Articles of Organization (Form LLC-1) with the California Secretary of State. This costs $70 if you file by mail or online. If you’re in a hurry, you can pay extra for expedited processing.

2. Annual Franchise Tax – $800

Yep, California has an annual LLC franchise tax of $800, no matter how much (or how little) your business makes. This is due by the 15th day of the fourth month after forming your LLC. So if you start your LLC in March, you’ll need to pay the $800 by July 15th.

💡 Bonus: If you form your LLC between September 15 and December 31, you get a little loophole—your first $800 payment isn’t due until the following tax year.

3. Statement of Information – $20

Within 90 days of forming your LLC, you need to file a Statement of Information (Form LLC-12) with the Secretary of State. This costs $20 and must be renewed every two years.

4. Additional Fees (If Applicable)

- LLC Gross Receipts Fee: If your LLC makes $250,000 or more per year, California hits you with an extra LLC Gross Receipts Fee ranging from $900 to $11,790.

- Registered Agent: If you don’t want to be your own registered agent, hiring one will cost around $100 to $300 per year.

- Operating Agreement: While not required to be filed, California mandates that your LLC has an Operating Agreement—whether written or verbal.

Total Upfront Cost?

- Minimum cost: $70 (Articles of Organization) + $800 (Franchise Tax) + $20 (Statement of Information) = $890.

- If your revenue is over $250K, expect to pay more.

Despite the high costs, California offers a massive market, strong branding opportunities, and an active startup scene. So if you’re ready to launch, just make sure to budget for the annual fees! 🚀

How long does it take to get an LLC in California?

Buckle up—it’s not the fastest process, but it’s definitely manageable! Here’s a breakdown of how long you’ll need to wait:

Standard Processing Times

- Online Filing – If you file through California’s online system, expect approval in about 8 business days. Not lightning-fast, but still reasonable!

- Mail Filing – Going the old-school route? Processing takes around 3 weeks, including mailing time. So, if patience isn’t your thing, this might not be the best option.

Need It Faster? California’s Got Expedited Services!

If you’re in a hurry (and willing to pay extra), here are your speedier options:

- 24-hour processing – $350

- Same-day processing (must file by 9:30 AM) – $750

- 4-hour processing (requires pre-clearance) – $500

In-Person Drop-Off Perks

If you’re in Sacramento, you can hand-deliver your documents for a $15 special handling fee. While this doesn’t guarantee same-day approval, it does get your filing in line faster than mailing it in.

What’s the Best Option?

For most people, filing online is the way to go—it’s affordable and takes about a week. But if you need your LLC ASAP, those expedited services can turn “waiting around” into “ready to roll” in no time! 🚀

Steps in detail to Start an LLC In California

Here are the 7 steps to form an LLC in California by yourself. Follow them and you will be able to get it done in no time.

Choose the Name

So, you’ve got the perfect name for your California LLC in mind—awesome! But before you get too excited, there’s one big step you need to take: making sure that name is actually available.

California, like all states, won’t let you register an LLC name that’s already taken by another business. That means you need to run an LLC name search to avoid delays, rejections, or worse—having to go back to the drawing board.

Don’t worry, though. The process is simple, and I’ll walk you through it in a quick and friendly way.

Step 1: Check California’s LLC Name Rules

Before you start typing your dream LLC name into a search bar, keep these California LLC rules in mind:

✅ Your LLC name must include “Limited Liability Company,” “LLC,” or “L.L.C.” at the end.

✅ It cannot include words like “Bank,” “Trust,” or “Insurance” unless you have special approval.

✅ The name must be unique from existing businesses in California. Even small differences (like adding an extra letter or punctuation) won’t make your name distinct.

Step 2: Search the California Business Name Database

California offers a free business name search tool through the Secretary of State’s website. Here’s how to use it:

- Go to the California Business Search tool – You can find it here.

- Enter your desired LLC name – Keep it simple! Just type the main part of your name without “LLC” to see similar results.

- Review the results – If an exact or super similar name pops up, you’ll need to tweak your name. If no results match, you’re in good shape!

Step 3: Double-check for Trademarks

Just because the name isn’t taken in California doesn’t mean you’re in the clear. Someone might have a federal trademark on the name.

✅ Head over to the U.S. Patent and Trademark Office’s database (USPTO.gov) and run a basic trademark search.

✅ If you see a live trademark on your name (especially in a related industry), consider changing it to avoid future legal trouble.

Step 4: Secure Your LLC Name (Optional but Smart!)

If your name is available but you’re not ready to file your LLC yet, you can reserve it with the California Secretary of State.

📌 How to reserve a name:

- Submit a Name Reservation Request (Form NA-1)

- Pay the $10 fee

- Your name will be held for 60 days

But honestly? If you’re ready to start your business soon, just go ahead and file your LLC—there’s no need to pay extra for a reservation.

In Short!

Checking your LLC name is a simple but crucial step. California is strict about name uniqueness, so take your time and make sure it’s available before filing.

Once you’ve confirmed your name is good to go, you’re all set to move forward with forming your California LLC. 🎉

Choose A Registered Agent

Think of a registered agent as your business’s official messenger, making sure you never miss an important notice from the state or a lawsuit (yikes).

But how do you pick the right one? And who can be a registered agent in California?

Let’s break it down in a friendly, easy-to-digest way.

✅ Who Can Be a Registered Agent in California?

California is pretty flexible about who can be your registered agent. Here are your options:

- You (The Business Owner) – Yes, you can be your own registered agent. But remember, your address will be public, and you need to be available during normal business hours (no midday beach trips).

- A Friend or Family Member – If you have someone willing to take on the role, they can do it as long as they have a California street address and are available during business hours.

- A Professional Registered Agent Service – These companies specialize in handling legal notices and keeping your address off public records. It’s the best option if you value privacy and don’t want to be glued to one location all day.

🔍 How to Choose the Right Registered Agent

With so many options, how do you decide? Here are some key factors to consider:

✅ Privacy Matters – If you don’t want your home address plastered all over state records, a registered agent service is a smart move.

✅ Reliability is Key – A registered agent must be available during business hours (Monday–Friday, 9 AM–5 PM). If you travel a lot or have an unpredictable schedule, a professional service ensures you won’t miss an important document.

✅ Compliance and Extra Perks – Some registered agent services offer compliance reminders, mail forwarding, and document scanning. This can be super helpful for staying on top of deadlines.

✅ Affordability – Prices vary, but most registered agent services charge around $100 to $200 per year. It’s a small price to pay for peace of mind.

⚖️ DIY vs. Hiring a Pro – What’s Right for You?

- If you’re okay with public records listing your home address, are always available during business hours, and don’t mind handling legal notices, then being your own agent is free and easy.

- If you value privacy, don’t want to be tied to an office, or just want a hassle-free experience, hiring a professional registered agent is the way to go.

🚀 Summary

Your registered agent plays an important role in keeping your LLC in good standing. If you’re cool with handling it yourself, go for it! But if you’d rather keep things private and stress-free, a professional service is a smart investment.

I recommend Registered Agents Inc.

Why? They are the best option. See some of the reasons below.

- They’re the Real Deal – Unlike middlemen who outsource registered agent services, Registered Agents Inc. actually runs the show. They own their offices in all 50 states, so you’re dealing with the actual provider, not some third party.

- Privacy is Their Superpower – California LLC info is public, but with Registered Agents Inc., their address goes on state records instead of yours. That means no junk mail, no random visitors, and no public listing of your home address.

- They Keep You in the Loop – Get instant alerts whenever legal documents arrive. They scan and upload your docs on the same day, so you’re never left guessing if something important shows up.

- Compliance? They’ve Got Your Back – California has some strict LLC rules, and missing deadlines can mean hefty fines. They’ll send you reminders for things like annual reports, so you stay in good standing with the state.

- Flat, Transparent Pricing – Their registered agent service costs $200 per year. No hidden fees, no sneaky upsells—just straightforward pricing.

- Nationwide Coverage – If you ever expand beyond California, they can cover your LLC in all 50 states without you needing to switch providers. That’s peace of mind if your business grows.

- They’re Business Formation Experts Too – If you’re just starting your LLC, they can handle the entire formation process for just $100 plus state fees. And yes, that includes a full year of registered agent service for free.

They’re Reliable, Efficient, and Worth It

If you want a reliable, no-nonsense registered agent for your California LLC, Registered Agents Inc. delivers. They keep your info private, send fast alerts, and help you stay compliant—all without any unnecessary upsells.

Want to keep your California LLC running smoothly? They’re a great pick! 🚀

🚀 Start Your LLC with the Best Formation Services!

Looking for the best LLC formation service? I’ve done the research for you! Here are our top 3 picks for hassle-free LLC formation:

- 🥇 Registered Agents Inc. – Premium service with expert compliance support.

- 🥈 Northwest Registered Agent – Privacy-focused and excellent customer service.

- 🥉 Bizee (formerly Incfile) – Budget-friendly with a free LLC formation option.

✅ Fast & Easy LLC Formation

✅ Trusted & Reliable Services

✅ Best Value for Your Money

File Articles Of Organization

Filing your Articles of Organization for a California LLC isn’t as scary as it sounds. In fact, it’s a pretty straightforward process—kind of like ordering your favorite coffee, but with a few extra steps. Let’s break it down in a way that makes sense and keeps things stress-free.

Download or Complete the Articles of Organization (Form LLC-1)

California makes this super easy. You have three ways to do it:

- Online: The fastest option! Use the California Secretary of State’s bizfile Online portal.

- By Mail: Print and fill out Form LLC-1, then mail it in.

- In Person: Hand-deliver it to the Sacramento office (but be ready for an extra $15 handling fee).

The filing fee is $70, and if you’re impatient (hey, no judgment), you can expedite it for an additional fee.

Step 3: Fill Out the Form (No Surprises Here!)

The Articles of Organization is just a simple, one-page form asking for:

- LLC Name (make sure it follows the rules from Step 1)

- Business Address (must be in California, no P.O. boxes)

- Registered Agent Information (this is the person or company that gets legal mail on behalf of your LLC)

- Management Structure (will you be running things yourself or with others?)

- Organizer’s Signature (that’s you!)

Submit and Wait for Approval

Once you’ve sent in your Articles of Organization, California takes about 5–10 business days to process standard filings.

- Online filings tend to be faster.

- Mailed filings take longer (plus mail delivery time).

- Walk-in filings are same-day if expedited.

You’ll get an approved copy by email or mail once everything is processed.

Thinking of Filing Your Articles of Organization Yourself?

If you’re confident in handling the paperwork, go for it! However, if you’re unsure and want to avoid costly mistakes, I highly recommend using a professional LLC formation service.

- 📌 1. Registered Agents Inc. – Premium business formation & one year of free registered agent services.

- 📌 2. Northwest Registered Agent – Privacy-focused, reliable, and includes a free first-year registered agent.

- 📌 3. Bizee – Affordable, beginner-friendly, and offers free LLC filing (just pay state fees).

🔹 Save time and ensure accuracy with a trusted service!

Draft an Operating Agreement

let’s talk about your Operating Agreement.

Sure, the state doesn’t require you to file one, but trust me, you absolutely need it. Think of it as your LLC’s playbook—keeping everything smooth and drama-free. So, what should you include?

Let’s break it down:

1. LLC Basics (The Intro Section)

Start with the essentials:

✅ LLC Name – Match exactly what’s on your Articles of Organization.

✅ Business Purpose – What does your LLC do? Keep it broad if you want flexibility.

✅ Principal Office Address – This is your LLC’s HQ (even if it’s your home).

✅ Registered Agent – Who’s handling official notices? (Hint: You or a service provider.)

2. Ownership Breakdown (Who Owns What?)

Now, let’s define who’s running the show:

✅ Members’ Names & Percentages – How much of the LLC does each person own? (This prevents that one friend from claiming half your business later.)

✅ Initial Contributions – Who’s pitching in cash, property, or sweat equity?

✅ Future Contributions – If the LLC needs more money, how will you handle it?

3. Management Style (Who’s the Boss?)

California LLCs can be:

✅ Member-Managed – All members are involved in running the business.

✅ Manager-Managed – You appoint someone (even a non-member) to handle operations.

Pro Tip: If you’re running a single-member LLC, still define management roles—you don’t want California to assume you’re a sole proprietorship.

4. Voting & Decision-Making (Avoid Power Struggles)

Nobody likes business disagreements, but they happen! So, set rules like:

✅ Voting Power – Is it based on ownership percentage or one member = one vote?

✅ Major vs. Minor Decisions – What requires full approval (e.g., selling the LLC) vs. everyday decisions (e.g., hiring employees)?

5. Profits, Losses & Taxes (Show Me the Money 💰)

California LLCs enjoy pass-through taxation, meaning profits flow to members. But how do you split them?

✅ Profit & Loss Distribution – Based on ownership or another method?

✅ Taxation Choice – Default LLC taxation, S-corp election, or something else?

✅ Year-End Accounting – Who’s in charge of bookkeeping and tax filings?

6. Adding or Removing Members (LLC Life Happens)

People join, people leave—let’s plan ahead:

✅ Admitting New Members – Do all members need to agree?

✅ Selling Membership Interests – Can members sell their share freely or do others get first dibs?

✅ What If a Member Leaves or Dies? – Set rules to avoid messy disputes.

7. Dissolution (If Things Go South 😢)

If you ever decide to close shop, here’s how to do it properly:

✅ Who Can Vote to Dissolve? – Majority or unanimous vote?

✅ Debt & Asset Handling – Pay off debts, then split remaining assets.

✅ Filing with the State – California requires a Certificate of Cancellation.

8. Miscellaneous Stuff (The Fine Print)

A few extra details to tie everything together:

✅ Operating Agreement Amendments – How can you make changes later?

✅ Governing Law – Your LLC follows California law (obviously).

✅ Signatures – All members should sign to make it official.

Your California LLC Operating Agreement is like a roadmap for your business—it keeps everyone on the same page and helps avoid future headaches. Even if you’re a one-person show, having an agreement proves your LLC is legit (especially for banks and legal matters).

Take the time to draft one, get it signed, and store it safely. Your future self will thank you! 🚀

Obtain the EIN for Your California LLC

An Employer Identification Number (EIN) is like a Social Security number for your California LLC—it’s a unique identifier assigned by the IRS. But why do you need one? Well, let’s break it down in a simple and friendly way.

Why Your California LLC Needs an EIN:

- Opening a Business Bank Account 🏦

Banks won’t let you open a business account without an EIN. They need it to track your LLC’s financial activities and ensure everything is legit. - Hiring Employees 👥

Thinking about building a team? The EIN is mandatory for hiring employees and handling payroll taxes. - Filing Taxes Properly 💰

Even if you’re a single-member LLC, having an EIN helps with tax reporting and makes filing smoother. Plus, if you elect S-corp status, the IRS requires an EIN. - Keeping Business and Personal Finances Separate 🔑

A separate EIN reinforces your LLC’s identity as a business, helping you maintain limited liability protection. - Avoiding Using Your SSN 🚫🔢

Without an EIN, you might have to use your Social Security Number (SSN) for business matters, increasing the risk of identity theft.

The Good News?

Getting an EIN is FREE and quick when you apply directly through the IRS. If your LLC is brand new, grab your EIN early to keep everything running smoothly! 🚀

If you are a non-US resident Check out my guide about how to obtain EIN as a non-US Resident. Yes, it’s still free.

Submit Your Initial Statement of Information

Filing a Statement of Information for your California LLC might sound like just another bureaucratic task, but trust me—it’s way easier than it seems. And the best part? Knocking it out on time keeps your LLC in good standing and avoids annoying penalties. So, let’s break it down step by step, in the friendliest way possible!

What is a Statement of Information?

Think of it as a quick check-in with the California Secretary of State to confirm that your LLC’s key details (like business address, members, and registered agent) are up-to-date. It’s required for every LLC, even if nothing has changed!

When Do You Need to File?

- First filing: Within 90 days of forming your LLC.

- Ongoing filings: Every two years (in the same month your LLC was formed).

For example, if you formed your LLC in June 2024, your next Statement of Information is due in June 2026—and so on.

How to File (Step-by-Step)

1. Gather Your LLC Info

Before you start, make sure you have:

✅ Your LLC name and entity number (you can look this up here).

✅ Your business address and mailing address (if different).

✅ The name and address of your registered agent (the person or company receiving legal notices).

✅ Names and addresses of LLC members or managers.

✅ Your business activity (a simple description of what your LLC does).

2. Choose How to File

You’ve got three options:

📌 Online: The easiest and fastest way! Head to the California Secretary of State website.

📌 By Mail: Download Form LLC-12 here, fill it out and mail it in.

📌 In-Person: If you’re feeling old-school, you can drop it off at their Sacramento office.

3. Pay the Filing Fee

- $20 for the standard Statement of Information.

- $250 if you’re late (ouch—so don’t miss the deadline!).

💡 Pro Tip: If nothing has changed since your last filing, you can submit a No Change Statement (Form LLC-12NC) instead of a full update—it’s free!

4. Submit & Save Your Confirmation

Once you file, save a copy of your confirmation email or receipt. This keeps you covered if there are ever any issues.

Filing your Statement of Information for a California LLC is quick, easy, and essential. If you set a reminder every two years, you’ll never have to stress about late fees. So, take 10 minutes, file it, and get back to running your awesome business! 🚀

Pay the California Annual LLC Tax and estimated fee

It’s time to handle the $800 annual LLC tax and (if your LLC makes $250,000 or more) the estimated LLC fee. But don’t worry—I’ll walk you through it in a way that won’t make your head spin.

Step 1: Pay the $800 Annual LLC Tax

This one is not optional. Every California LLC must pay $800 to the Franchise Tax Board (FTB) every year. Here’s how to do it:

✅ Due Date:

- If your LLC was formed in California, the first $800 is due by the 15th day of the 4th month after your LLC was approved. (For example, if you formed your LLC in June, your payment is due by October 15.)

- For every year after that, the payment is due by April 15.

✅ How to Pay:

- Fill out Form 3522 (LLC Tax Voucher)—this form basically tells the FTB who you are and why you’re sending them money.

- Pay online at the California FTB website or mail a check with Form 3522.

Step 2: Pay the Estimated LLC Fee (If You Make $250,000+)

If your LLC is bringing in serious money ($250,000 or more), the state charges an extra LLC fee based on your revenue. It ranges from $900 to $11,790, depending on how much you make.

✅ Due Date:

- The estimated fee must be paid by June 15 of each year.

- You’ll also file Form 3536 to report your estimated revenue and payment.

✅ How to Pay:

- Pay online through the FTB’s Web Pay system (fast and easy).

- Or mail Form 3536 along with a check.

Final Step: File Your LLC Return

Even if you paid everything on time, California still wants paperwork. You’ll need to file Form 568 (LLC Return of Income) with the FTB by April 15 each year. This form sums up your earnings, confirms your payments, and ensures you’ve squared away with the state.

What Happens If You Don’t Pay?

⚠️ Late Payment = Penalties + Interest

- Miss the April 15 deadline? The FTB slaps on a penalty, plus interest.

- Skip the $800 tax for too long? The state might shut down your LLC (yikes).

Yes, California has some of the highest LLC fees in the country, but as long as you stay ahead of the deadlines and file the right forms, it’s not too painful. Just mark your calendar, file online when possible, and don’t ignore those FTB notices.

Need more details? Check out the Franchise Tax Board’s website and keep your LLC in good standing.

What do I do after my California LLC is approved?

Alright, your California LLC is officially approved—congrats! But hold up, you’re not done just yet. There are a few key things you need to do to keep your LLC running smoothly (and legally). Here’s your post-approval to-do list:

Open a Business Bank Account

Mixing business and personal finances is a no-go. A dedicated business account keeps things clean for taxes and liability protection. Bring your EIN, LLC approval documents, and Operating Agreement when you visit the bank.

Get Necessary Business Licenses & Permits

California loves paperwork, so check if your business needs local, state, or industry-specific licenses. The CalGold website can help you figure out what’s required for your business type and location.

Register for State Taxes (If Needed)

If you’re selling products, hiring employees, or running a business that owes state taxes, you might need to register with the California Department of Tax and Fee Administration (CDTFA).

Stay on Top of Compliance

- File your Statement of Information every 2 years (yes, California loves updates).

- Keep records of income and expenses for tax season.

- Consider working with an accountant to stay ahead of tax deadlines.

Start Running Your Business!

With all the legal stuff in check, it’s time to focus on what really matters—growing your business. Whether you’re launching a side hustle, an online shop, or a service-based company, now’s your moment. Go crush it!

How my California LLC will Be taxed?

It’s super important to understand how it will be taxed—because California doesn’t mess around when it comes to fees and deadlines. But don’t worry, I’ll break it down in a friendly, no-nonsense way so you know exactly what to expect.

And since taxes can be a pain, I’ll also show you how Doola’s bookkeeping service can help keep things stress-free.

1. The Infamous $800 California LLC Tax

First things first—California wants its money.

No matter if your LLC makes $1 or $1,000,000, you have to pay an $800 annual tax to the state. This is basically California’s way of charging you rent for doing business here. The payment is due by the 15th day of the 4th month after you form your LLC.

💡 Example:

- You formed your LLC in January → The $800 is due by April 15.

- You formed your LLC in September → The $800 is due by January 15.

And yes, you have to pay this every year, so don’t forget!

2. The “Oh No, I Made Money” Gross Receipts Fee

California also charges an extra fee if your LLC makes $250,000 or more in gross revenue (not profit—just total money coming in). Here’s the breakdown:

| Gross Revenue | Extra Fee |

|---|---|

| $250,000 – $499,999 | $900 |

| $500,000 – $999,999 | $2,500 |

| $1,000,000 – $4,999,999 | $6,000 |

| $5,000,000+ | $11,790 |

🔹 Due Date? June 15 each year.

🔹 Who has to pay? Any LLC making $250K or more in total revenue.

If you’re growing fast, be ready for this extra cost so it doesn’t catch you off guard!

3. Federal and State Income Taxes (Depends on Your LLC Type)

Your California LLC doesn’t pay federal income tax itself unless you elect C-Corp taxation—instead, the profits pass through to you, the owner(s), who report it on personal tax returns. But how you’re taxed depends on how your LLC is structured:

👤 Single-Member LLC (Default Taxation)

- You’re taxed as a sole proprietor, meaning your LLC’s income goes on your personal tax return (Form 1040, Schedule C).

- You also owe self-employment tax (15.3%) on profits, which covers Social Security and Medicare.

👥 Multi-Member LLC (Default Taxation)

- Your LLC is treated as a partnership and files a California Form 565 + federal Form 1065.

- Profits are divided among members, who report them on their personal tax returns.

📈 LLC Taxed as an S-Corp (For Tax Savings)

- If you choose S-Corp taxation, you file a California Form 100S and a federal Form 1120S.

- You pay yourself a salary (which is taxed normally), but any extra profits are distributed as dividends, which aren’t subject to self-employment tax—this can save you serious money.

🏢 LLC Taxed as a C-Corp

- If your LLC elects C-Corp taxation, it’s subject to California’s 8.84% corporate tax or the $800 minimum franchise tax, whichever is higher.

If you’re not sure which option is best for you, this is where a good bookkeeper (like Doola!) can really help.

4. Sales Tax (If You Sell Stuff)

If your LLC sells physical products in California, you must register for a California Sales Tax Permit and collect sales tax.

🔹 Where to register? The California Department of Tax and Fee Administration (CDTFA).

🔹 How much is sales tax? It depends on your location, but the state base rate is 7.25%, and local areas can tack on more.

5. Self-Employment Tax (If You’re a Solo LLC Owner)

If your LLC is taxed as a sole proprietorship or partnership, you owe self-employment tax on your net profits, which is 15.3% (ouch).

🔹 Why? Because you have to pay both the employer and employee portion of Social Security and Medicare.

🔹 How to reduce it? S-Corp election can help lower these taxes by shifting some income to dividends.

6. Estimated Tax Payments (California Loves Deadlines)

California requires LLC owners to pay estimated taxes quarterly if they expect to owe $500 or more in state taxes.

🗓 Due Dates for Estimated Taxes:

- April 15

- June 15

- September 15

- January 15 (of the next year)

Missing these can lead to penalties and interest, so it’s important to stay on top of them!

Why Doola’s Bookkeeping Service Is a Life-Saver for California LLC Owners

Let’s be real—California LLC taxes are complicated. Between the $800 annual tax, gross receipts fees, self-employment tax, and estimated payments, it’s a lot to keep track of.

That’s where Doola comes in.

✅ Tracks Your LLC’s Income & Expenses (so you don’t have to dig through receipts)

✅ Handles Bookkeeping Year-Round (so tax season isn’t a nightmare)

✅ Helps You Reduce Your Tax Bill (by making sure you claim every deduction)

✅ Files Your Federal & State Taxes (so you don’t have to stress about deadlines)

Instead of scrambling at tax time, Doola makes sure your California LLC stays tax-compliant and financially healthy all year long.

💡 Thinking about getting help with your bookkeeping?

Check out Doola’s bookkeeping service and let the pros handle your LLC’s finances—so you can focus on growing your business! 🚀

Cherry on top! I have a 10 percent discount you can use Code: DOOLAREHAN10 to get 10 percent off your order.

Conclusion: How to Start an LLC In California

And there you have it—your roadmap to forming an LLC in the Golden State! From picking the perfect business name to filing your Articles of Organization and staying compliant, you’re now equipped with everything you need to make your dream official.

Starting an LLC in California may come with a few extra steps (and fees—because, well, it’s California), but the benefits of legal protection, credibility, and flexibility are totally worth it. Now, all that’s left is to launch your business, provide amazing products or services, and enjoy the perks of being your own boss.

So, go ahead—make it official! Your California LLC is just the beginning of an exciting entrepreneurial adventure. 🚀

California LLC FAQs

Here are the answers to the question you asked

Do I need a registered agent for my California LLC?

Yep! Every LLC in California needs a registered agent—a person or company that receives legal notices for your business.

You can:

✅ Be your own registered agent (if you have a California address and are available during business hours).

✅ Hire a professional registered agent service (recommended if you want privacy).

💡 Pro Tip: If you use a service, it helps keep your home address off public records.

What’s the deal with the $800 annual franchise tax?

California is serious about its taxes. Every LLC must pay $800 per year to the California Franchise Tax Board (FTB), starting in its second year of operation.

🚨 Exception Alert! If you form your LLC in 2021–2025, you don’t have to pay this fee in your first taxable year.

Do California LLCs have an annual report?

Yes, but it’s called the Statement of Information (Form LLC-12).

📅 Due date:

- Your first Statement of Information is due within 90 days of forming your LLC.

- After that, you’ll file it every 2 years.

💰 Filing fee: $20

💡 Forget to file? There’s a $250 late fee, so mark your calendar!

Can I form a California LLC if I live in another state?

Absolutely! You don’t need to live in California to form a California LLC, but you do need:

✅ A California business address (or use a registered agent service).

✅ To pay California’s $800 annual franchise tax (yes, even if you live elsewhere).

Do I need an Operating Agreement for my California LLC?

Yes! Even though California doesn’t require you to file it, every LLC must have an Operating Agreement—even if you’re a single-member LLC.

Why?

✅ It protects your limited liability status.

✅ It lays out rules for running your LLC.

✅ It helps prevent disputes (if you have business partners).

Can I change my California LLC name later?

Yes! If you ever decide your LLC name isn’t the perfect fit anymore, you can change it by filing a Certificate of Amendment (Form LLC-2).

💰 Filing fee: $30

🚀 Pro Tip: Before changing your name, check if the new one is available on the California Secretary of State’s website!

Is California a good State to form an LLC?

California is a mixed bag when it comes to forming an LLC. It’s a fantastic place to do business if you’re physically operating there, but it’s not the most wallet-friendly state for an LLC. Here’s why:

The Good Stuff ✅

- Strong Economy – California has one of the largest economies in the world, so if you’re in tech, entertainment, or startups, it’s a solid choice.

- Business Opportunities – The state is full of investors, networking opportunities, and potential customers.

- Legal Protection – Like all LLCs, forming one in California gives you limited liability protection, meaning your personal assets stay safe.

The Not-So-Great Stuff ❌

- $800 Annual Franchise Tax – This is the biggest downside. Every California LLC pays an annual minimum tax of $800, even if you make no money.

- Extra Fees for Higher Revenue – If your LLC earns more than $250,000 per year, California also tacks on additional gross receipts fees.

- Strict Compliance Rules – The state requires a Statement of Information ($20) every two years and has more regulations than many other states.

Who Should Form an LLC in California?

If you live and operate in California, it’s often unavoidable. You’ll generally need to register your business there anyway.

Bottom Line 🏁

California is a great place to run a business but not necessarily the best place to form an LLC—especially if you want to save on taxes and fees. If you’re already in California, it makes sense. If not, you might want to think twice.

Is California a Good State for Non-US Residents to Form an LLC? 🌍

If you’re a non-US resident looking to form an LLC in the United States, California might not be your best bet—unless you absolutely need to operate there. Here’s why:

Pros for Non-US Residents ✅

- No Residency Requirement – You don’t need to live in California (or the U.S.) to form an LLC here.

- Strong Market & Business Hub – If your business involves tech, entertainment, e-commerce, or startups, California is a global hotspot.

- International Appeal – Many investors and customers worldwide recognize California-based businesses, which can help build credibility.

Cons for Non-US Residents ❌

- $800 Annual Franchise Tax – Regardless of how much your business earns, California charges an annual minimum tax of $800.

- Additional Revenue-Based Fees – If your LLC makes over $250,000, you’ll owe extra gross receipts taxes.

- High Cost of Compliance – California has stricter regulations, more paperwork, and ongoing filing requirements than many other states.

- Foreign Qualification Requirement – If your business is mainly operating in another state but registered in California, you may still need to register as a foreign LLC elsewhere—doubling your compliance burden.

Better Alternatives for Non-US Residents? 🌎

If you don’t need to physically operate in California, Wyoming, Delaware, or New Mexico could be better options:

- Wyoming – No state income tax, no franchise tax, and privacy-friendly.

- Delaware – Preferred for international businesses and startups looking for investors.

- New Mexico – Low costs and no annual reporting requirements.

Bottom Line for Non-US Residents 🏁

If you need a presence in California, go for it—just be prepared for high fees and strict compliance rules. But if you’re just looking for an LLC-friendly state with fewer costs and headaches, California is not the best option for non-US residents

The material on this website is intended for general information purposes only and should not be construed as legal, tax, or financial advice. Laws and regulations vary by jurisdiction and might change over time. It is critical to obtain specialized guidance that fits your individual situation. The opinions presented here are purely those of the writers and should not be considered professional advice. For any legal or tax-related issues, it is best to speak with a certified specialist who can give specialized advice based on your specific circumstances.