Starting a business in the Centennial State? Good choice! Colorado is a fantastic place to launch your LLC, whether you’re building the next big thing or just want to protect your personal assets while running a side hustle. The process is fairly straightforward, but there are a few key steps you’ll need to follow to make sure your business is legally set up and ready to roll.

In this guide, I’ll walk you through how to start an LLC in Colorado step by step—without the confusing legal jargon. Whether you’re forming your first business or you’ve done this before, I’ll keep things simple, clear, and, most importantly, stress-free. Ready to make your business official?

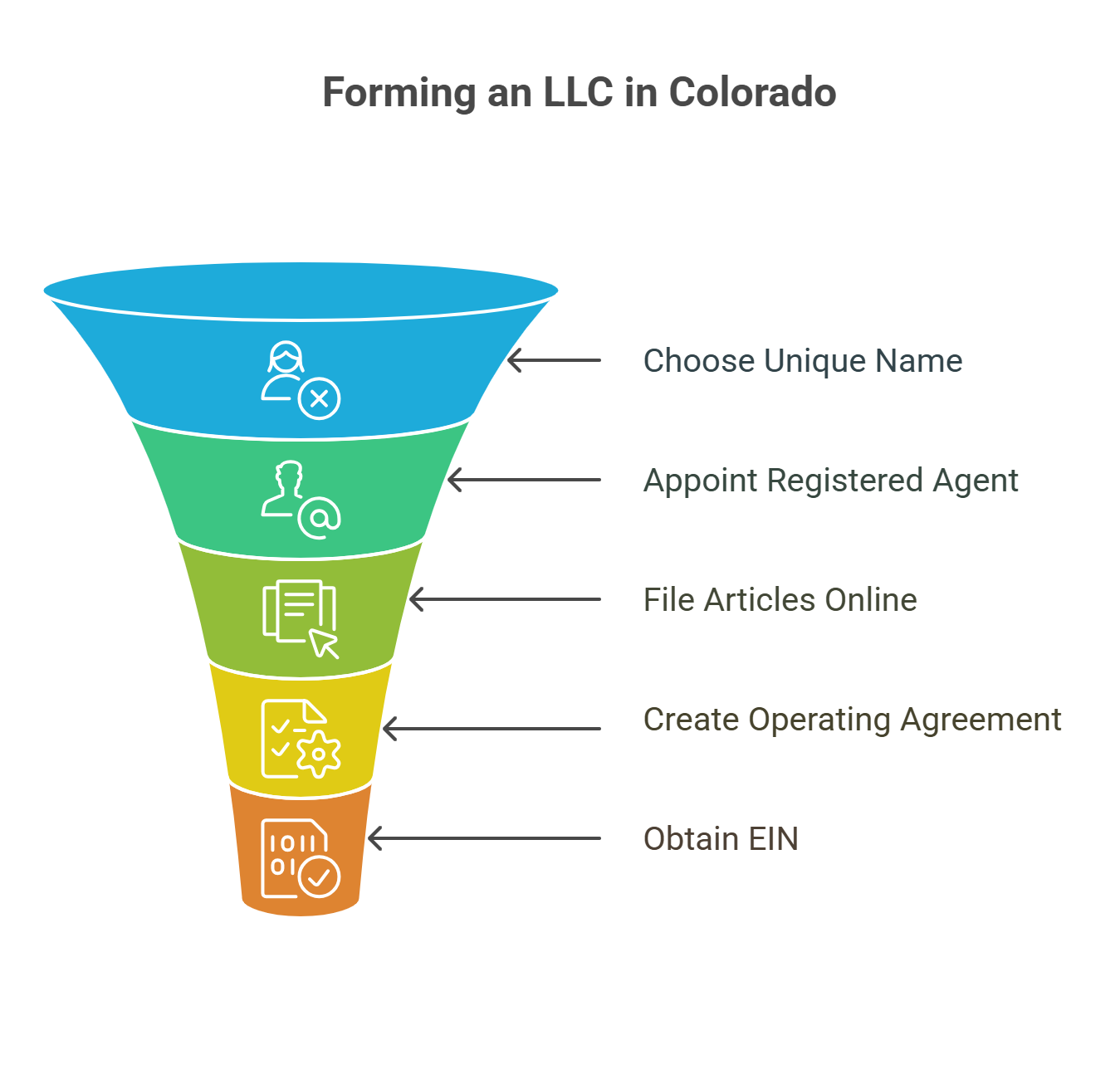

How to Start an LLC in Colorado in 5 Simple Steps 🚀

1️⃣ Pick a Unique Name – Your LLC needs a name that follows Colorado’s rules and isn’t already taken.

2️⃣ Appoint a Registered Agent – This person or service will handle your legal mail—don’t skip this step!

3️⃣ File Your Articles of Organization – Submit this form online with the Colorado Secretary of State and pay the $50 filing fee.

4️⃣ Create an Operating Agreement (Optional but Smart!) – It’s like a business roadmap, keeping things organized—even for solo LLCs.

5️⃣ Get an EIN from the IRS – This is your LLC’s ID number for taxes, banking, and more. It’s free and easy to get!

🔹 Pro Tip: Colorado LLCs must file an annual periodic report for $10—mark your calendar so you don’t miss it!

If you want to DIY it yourself keep reading the article till the end. Need help or have a fear of making mistakes the following companies are best will handle all the paperwork and Colorado registered agents’ duties without a sweat.

These Companies Make LLC Formation Easy & They Are Best for Colorado!

Starting an LLC in Colorado? These top-rated services handle the paperwork so you don’t have to.

✅ Registered Agents Inc. – Fast & Reliable LLC Formation

✅ Northwest Registered Agent – Privacy & Expert Support

✅ Bizee (Formerly Incfile) – Free LLC Formation (+ State Fees)

Here are the 5 steps for Forming an LLC in Colorado

Follow the steps below to start a Colorado LLC by yourself

Colorado LLC Name Search and Rules

Choosing the right name for your Colorado LLC is a big deal! It’s the first impression your business makes, and you want it to be legal, available, and memorable. So before you get too attached to a name, let’s go over the Colorado LLC name rules and how to check if your name is available.

Step 1: Colorado LLC Name Rules

Before you start brainstorming, your name has to follow some state-mandated rules. Here’s what Colorado requires:

✅ Must Include “LLC” – Your name must contain one of the following:

- Limited Liability Company

- LLC

- L.L.C.

🚫 No Confusing It with Government Agencies – You can’t use words like FBI, Treasury, State Department, or anything that makes it seem like you’re a government agency.

📝 Restricted Words Require Extra Steps – If your name includes words like “Bank,” “Attorney,” or “University,” you may need additional paperwork or a licensed professional to be involved in your business.

🔄 Must Be Unique – Your name cannot be identical or too similar to an existing business in Colorado. More on this next!

Step 2: Check If Your Name Is Available

You’ve got a name idea—great! But don’t print business cards just yet. You need to make sure no one else has claimed it.

🔍 How to Do a Colorado LLC Name Search:

- Visit the Colorado Secretary of State’s website

- Go to the Colorado Business Name Search tool.

- Enter your desired LLC name and search.

- Look for conflicts – If an exact match or something too similar pops up, you’ll need to tweak your name.

💡 Pro Tip:

Even if your name is available, check the domain name too! A matching website URL can make your business look more professional.

Step 3: Reserve Your Name (Optional)

Not ready to file your LLC yet but want to save your name? Colorado lets you reserve a business name for 120 days for a $25 fee. You can do this online through the Colorado Secretary of State.

Step 4: Lock It In by Forming Your LLC

Once you’ve found the perfect name, the best way to secure it is to file your LLC formation documents. Until you officially register, someone else can still grab it.

🚀 Ready to Make It Official?

You can file your Articles of Organization with the Colorado Secretary of State online for just $50. Processing is fast, so you’ll have your LLC name locked in quickly.

Summary

Picking a Colorado LLC name is exciting, but it’s also important to follow the rules. Do your name search, make sure it meets state requirements, and secure it before someone else does.

🔹 Key Takeaways:

✅ Your name must include “LLC” or similar.

✅ It must be unique and not resemble an existing business.

✅ Avoid restricted words or anything confusingly similar to government entities.

✅ Use the Colorado Business Name Search tool to check availability.

✅ Reserve your name if needed, but filing your LLC is the best way to secure it.

Now, go find that perfect name and Move to the next step.

Appoint a Registered Agent

The second is appointing a registered agent—and not just any agent, but one that actually does the job right. A registered agent is your LLC’s official point of contact for legal documents, government notices, and other important paperwork. So, let’s dive into what makes a good Colorado registered agent and how to pick the best one for your business.

What Does a Colorado Registered Agent Do?

Think of a registered agent as your business’s mailroom manager for official stuff. Here’s what they handle:

- Accepting Legal Documents – If your LLC gets sued (hopefully never, but hey, business happens), your registered agent receives the legal notices.

- Receiving Government Notices – The Colorado Secretary of State might send reminders about annual reports or compliance updates.

- Keeping You Compliant – Forgetting a deadline? A good registered agent will send you alerts to keep your business in good standing.

- Maintaining Privacy – Rather not have legal papers served at your home or business? A registered agent keeps your address off public records.

Who Can Be a Registered Agent in Colorado?

Colorado law is pretty flexible when it comes to who can be your registered agent. Here are your options:

- You (the Business Owner) – Yes, you can be your own registered agent if you have a physical address in Colorado (no P.O. boxes allowed). But be prepared to have your info on public records and be available during business hours.

- A Friend, Family Member, or Employee – Someone else can serve as your registered agent if they meet the same address and availability requirements.

- A Professional Registered Agent Service – These companies specialize in handling registered agent duties and ensuring you never miss an important document.

📢 Need a Professional Registered Agent?

If you don’t have an address in the state or want to keep your personal information private, hiring a professional registered agent is the best solution!

File Articles of Organization with the State of Colorado

🚀 Step 1: Head to the Colorado Secretary of State’s Website

Colorado keeps things simple. Instead of mailing paper forms, all LLC filings are done online through the Colorado Secretary of State’s website. That means no waiting for snail mail, and your LLC can be approved almost instantly! 🎉

👉 Here’s the direct link to get started: Colorado Secretary of State Business Filings

📜 Step 2: Fill Out the Articles of Organization

Once you’re on the website, select “Limited Liability Company (LLC)” and fill out the required details, including:

✅ LLC Name – Colorado requires your LLC name to be unique, so double-check its availability using the Business Name Search tool before filing. (Pro tip: Your LLC name must include “Limited Liability Company,” “LLC,” or “L.L.C.” at the end.)

✅ Principal Office Address – This is where your LLC will be based. It can be your home, an office, or even a virtual address.

✅ Registered Agent Information – Every Colorado LLC needs a registered agent to receive legal documents. This can be you, a friend, or a professional service, as long as they have a Colorado street address.

✅ Management Structure – Decide if your LLC will be member-managed (run by owners) or manager-managed (run by appointed managers).

✅ Organizer Information – The person filling out the form (probably you!) must enter their name and contact details.

💰 Step 3: Pay the Filing Fee

The Colorado LLC filing fee is $50, which is one of the lowest in the U.S. (Nice, right? 😊) You’ll need to pay this fee online via credit or debit card when submitting your Articles of Organization.

📄 Step 4: Submit & Get Approved

Once you’ve double-checked everything, hit submit! Since Colorado processes LLC filings instantly, your business will be officially formed right away (as long as there are no errors in your filing).

🚀 Thinking You Can Make a Mistake? 🤔

If That’s the Case, Choose the Best LLC Services for Colorado!

Starting an LLC in Colorado? The wrong choice could cost you time, money, and frustration. That’s why I’ve handpicked the top 3 services that make LLC formation fast, easy, and stress-free!

🥇 Registered Agents Inc.

Best for privacy & premium business support

🥈 Northwest Registered Agent

Best for top-tier customer service & simplicity

🥉 Bizee (Formerly Incfile)

Best for budget-friendly LLC formation ($0 + state fee)

💡 Don’t leave your LLC formation to chance. Click On Desired Company and start with the best!

Create an Operating Agreement

What’s the Purpose of an Operating Agreement?

An Operating Agreement is like the rulebook for your Colorado LLC. While the state doesn’t legally require one, having it is a smart move because it lays out how your business runs, who owns what, and what happens if things go sideways.

Think of it like a prenup for your business—it keeps everyone on the same page and helps avoid messy disputes down the road. Plus, it proves that your LLC is a legit separate entity, which is crucial for protecting your personal assets.

What to Include in Your Colorado LLC Operating Agreement

1. Basic Business Info

Start with the essentials:

- LLC Name (Must match what’s on your Colorado Articles of Organization)

- Business Address

- Formation Date

- Registered Agent Details (The person or service receiving legal papers for the LLC)

2. Ownership Breakdown

Who owns what? If you’re a single-member LLC, this is easy—it’s all yours! But if you have partners (aka members), list out:

- Each member’s ownership percentage

- How much each person contributed (cash, property, services, etc.)

3. Management Structure

Your LLC can be:

- Member-Managed (Owners run the day-to-day)

- Manager-Managed (You appoint a manager to handle operations)

Clearly state who’s in charge of what so there’s no confusion later.

4. Voting Rights & Decision-Making

How do big decisions get made? Some LLCs go by majority vote, while others require unanimous approval for major moves (like bringing in a new member or selling the business).

5. Profit & Loss Distribution

Who gets what when the money rolls in?

- Will profits be split based on ownership percentages?

- Are there special distributions or reinvestment rules?

This section ensures everyone knows how and when they get paid.

6. Member Responsibilities & Roles

What’s expected from each member? If someone is bringing money, skills, or sweat equity, spell out those contributions. This prevents disputes about who’s supposed to do what.

7. What Happens If a Member Leaves?

Life happens—people quit, retire, or (knock on wood) pass away. Plan ahead for:

- Buyout rules (Who gets first dibs on buying their share?)

- Valuation method (How will the member’s stake be valued?)

- Restrictions on selling (Can they sell to an outsider, or do other members get the first option?)

8. Dissolution Plan (Worst-Case Scenario)

If you ever decide to close the LLC, how will assets be divided, debts paid, and legal matters wrapped up? It’s best to agree on this before problems arise.

9. Amendments & Updates

Your business will evolve, so make sure there’s a process for updating the Operating Agreement. Many LLCs require a majority vote to make changes.

In short!

Even though Colorado doesn’t require an Operating Agreement, having one can save you from major headaches. It protects your personal assets, prevents disputes, and makes your business feel legit in the eyes of banks and investors.

If you’re a solo business owner, it’s still a good idea—because it proves your LLC is separate from you personally, which is important for liability protection.

So, whether you’re running a small side hustle or building the next big thing, an Operating Agreement keeps everything crystal clear and drama-free. 🎯

Obtain the EIN from The IRS

If you’re forming an LLC in Colorado, you might have heard about something called an EIN—short for Employer Identification Number. Sounds official, right? Well, it is! But don’t let the name fool you. Even if you don’t have employees, your LLC might still need one.

Think of an EIN as your LLC’s Social Security Number. Just like you have a unique number tied to your personal finances, your LLC gets its own when you apply for an EIN through the IRS. This number helps the government track your business for tax purposes.

Why Does Your Colorado LLC Need an EIN?

- Taxes, Taxes, Taxes – If your LLC has multiple members, hire employees, or elects to be taxed as an S-corp, the IRS requires an EIN to handle tax filings. Even single-member LLCs might need one if they have employees or certain tax obligations.

- Business Banking – Most banks won’t let you open a business bank account without an EIN. Keeping your business and personal finances separate is crucial for liability protection (and staying on the IRS’s good side).

- Hiring Employees – Planning to grow your business? If you hire employees in Colorado, you’ll need an EIN to handle payroll taxes and report wages to the state and IRS.

- Building Business Credit – An EIN is often required to establish business credit, which helps your LLC qualify for loans, credit cards, and vendor accounts under its own name.

Do You Really Need One?

If you’re a single-member LLC with no employees, you may be able to get by without an EIN and just use your Social Security Number. However, many business owners prefer to get an EIN to protect their personal identity and keep things professional.

How Do You Get an EIN?

It’s free and easy! You can apply online through the IRS website, and you’ll usually get your EIN immediately. No long wait times, no hidden fees—just a simple process to get your Colorado LLC set up properly.

f you’re a non-US resident, you can still get an EIN for your Colorado LLC, but not online—you’ll need to apply via FAX or mail using Form SS-4. Check out my detailed guide on how to obtain an EIN as a non-US resident for step-by-step instructions!

Bottom Line?

Even if an EIN isn’t required for your Colorado LLC, it’s a smart move. It makes tax filing easier, lets you open a business bank account, and protects your personal identity. And since it’s free, there’s really no downside to getting one!

What do I do after my LLC is approved in Colorado?

Open a Business Bank Account (Keep Those Finances Separate!)

Mixing personal and business finances is a big no-no. A dedicated business bank account keeps everything clean and helps protect your limited liability. Most banks will need:

✅ Your approved Articles of Organization

✅ Your EIN

✅ An Operating Agreement

Register for Colorado State Taxes (If Needed)

Not all LLCs have to register with the Colorado Department of Revenue, but if you’re selling goods, hiring employees, or offering taxable services, you might need a sales tax license or withholding tax account. Check out the Colorado Revenue Online portal to see what applies to you.

Know Your Annual LLC Filing Requirement

Colorado requires an annual report called the Periodic Report, which costs $10 and is due every year to keep your LLC in good standing. Forgetting to file? That’ll lead to late fees and eventually administrative dissolution (which sounds scary because it is).

Get the Right Business Licenses & Permits

LLC approved? ✅ But hold on—your industry may require business licenses or permits at the state, county, or city level. For example, if you’re running a food truck, a contractor business, or a salon, you’ll likely need extra approvals. Use the Colorado Business Express website to check what’s required.

Consider Business Insurance

If you have employees, workers’ compensation insurance is required by law in Colorado. Even if you’re a solo entrepreneur, general liability insurance can be a lifesaver. Think of it as an extra layer of protection for your business.

Set Up an Accounting System (Don’t Rely on Memory!)

Good bookkeeping is crucial! Whether you use QuickBooks, Wave, or an accountant, tracking your expenses, income, and taxes from day one will save you headaches (and possibly IRS trouble) down the road.

If you’re looking for top-notch bookkeeping services, Doola is a solid choice!

🚀 Why Doola Bookkeeping is the Best:

- Human-Powered, Not Just AI 📊 – Unlike some services that rely only on AI, Doola gives you real human bookkeepers who actually understand your business finances. No more confusing reports—just clear, expert-managed books.

- Perfect for Entrepreneurs & Startups 🌱 – Whether you’re running an LLC, e-commerce store, or a side hustle, Doola’s bookkeeping is designed to keep your finances organized without the headache.

- All-in-One Financial Solution 💼 – They don’t just track your numbers. Doola handles income, expenses, tax-ready reports, and even monthly financial statements, so you always know where your business stands.

- Seamless Tax Prep 📑 – Stay ahead of tax season! Doola helps ensure your books are clean and ready for filing—saving you time and money on accountants.

- Affordable & Transparent Pricing 💰 – No crazy hidden fees! Doola offers flat-rate pricing so you’re not paying more than you need to.

- Syncs with Your Business Tools 🔄 – Whether you use Stripe, PayPal, Shopify, or QuickBooks, Doola integrates smoothly, keeping everything in one organized place.

- Subscription-Based for Hassle-Free Service ✅ – Like their LLC services, Doola bookkeeping is on a subscription model, so you get ongoing support and updates without the hassle of hourly billing.

🎁 Exclusive 10% Discount!

Since I’ve partnered with Doola, you can save 10% on your bookkeeping services! Just use the code DOOLAREHAN10 at checkout.

If you want stress-free bookkeeping with expert support, Doola is the way to go! 🚀

Start Branding & Marketing Your Business

Now for the fun part—getting the word out! Secure your domain name, set up a business email, and create social media pages. Whether you’re launching a website or getting listed on Google My Business, building an online presence is key.

Enjoy the Journey!

Starting an LLC is a big step, but now you’re officially your own boss! Keep learning, networking, and growing. And remember—if you ever get stuck, Colorado has plenty of business resources, free mentorship programs, and networking opportunities to help you along the way.

How My Colorado LLC Will Be Taxed?

Ah, taxes—the one thing you can’t escape, even in the breathtaking mountains of Colorado! If you’ve formed an LLC in Colorado, here’s how the state will tax your business:

1. No State-Level LLC Tax or Franchise Tax

Great news! Colorado does not charge a separate state-level LLC tax or franchise tax. Unlike some states that nickel and dime you with extra fees, Colorado keeps it simple.

2. Pass-Through Taxation (Default LLC Taxation)

By default, your Colorado LLC will be taxed as a pass-through entity. This means:

- The LLC itself doesn’t pay income tax.

- Profits (or losses) “pass-through” to your personal tax return.

- You’ll pay Colorado’s flat 4.40% state income tax on your share of the LLC’s profits.

3. Self-Employment Taxes (If You’re a Single-Member or Multi-Member LLC)

- Since the IRS doesn’t recognize LLCs as a tax entity, single-member LLCs are taxed like sole proprietorships. That means you’ll pay a 15.3% self-employment tax on your net earnings (covering Social Security & Medicare).

- Multi-member LLCs? Each member pays self-employment taxes on their share of the profits.

4. Electing S-Corp Taxation (Optional, for Tax Savings)

If your LLC is making solid profits, you can elect S-corp status to save on self-employment taxes. Instead of paying self-employment tax on all profits, you’ll pay yourself a reasonable salary (which is subject to payroll taxes), and the remaining profits aren’t hit with self-employment tax. But, you’ll have to file an extra tax return.

5. Colorado Sales Tax (If You Sell Products or Services)

- State Sales Tax: 2.9% (Lowest in the U.S.!)

- Local Sales Tax: This can bring the total rate up to 8-9% depending on the city.

- If you sell taxable products or services, you’ll need to register with the Colorado Department of Revenue and collect/remit sales tax.

6. Colorado Payroll Taxes (If You Have Employees)

- Colorado’s state income tax withholding applies to employee wages.

- You’ll also pay unemployment insurance tax and workers’ comp insurance.

7. Business Personal Property Tax

If your LLC owns business equipment (computers, tools, machinery, etc.) worth over $50,000, you’ll need to file a Business Personal Property Tax Declaration and pay taxes on it.

In simple words!

Your Colorado LLC enjoys simple taxation, with no franchise tax and a flat 4.40% state income tax rate. Just keep track of your income, sales tax obligations, and payroll taxes (if applicable), and you’ll be all set. Now, back to enjoying those Rocky Mountain views! 🏔️

Final Thoughts: Your Colorado LLC is Ready to Roll!

And there you have it—your roadmap to launching an LLC in Colorado! From picking the perfect name to filing your Articles of Organization, getting an EIN, and keeping up with annual requirements, you’re now equipped with everything you need to make your business official.

Colorado is a fantastic place to start and grow a business, offering a strong economy, business-friendly laws, and no state-level franchise tax (that’s a win!). Whether you’re launching a solo venture or building the next big thing, your LLC gives you legal protection and flexibility—so you can focus on what really matters: growing your business.

So, what’s next? Open that business bank account, get your website up, and start making waves in the Centennial State. If you ever need help, there are plenty of resources and experts out there, but now you know the essentials. Here’s to your success! 🚀

FAQs About Starting an LLC in Colorado

1. How much does it cost to start an LLC in Colorado?

Starting an LLC in Colorado is super affordable! The Colorado Secretary of State charges just $50 to file your Articles of Organization. Yep, that’s it! No hidden fees, no extra charges—just a flat $50 to make your LLC official.

2. How do I form an LLC in Colorado?

Starting an LLC in Colorado is a breeze. Here’s the simple step-by-step process:

- Choose a Name – Make sure it’s unique and includes “LLC” or “Limited Liability Company” at the end.

- Appoint a Registered Agent – This is the person or company that handles official mail and legal notices for your LLC. You can be your own registered agent, or you can hire a service.

- File the Articles of Organization – Submit your paperwork online with the Colorado Secretary of State (takes minutes!).

- Create an Operating Agreement (optional but recommended) – This document outlines how your LLC will run.

- Get an EIN – This is your business tax ID from the IRS (free to apply).

- File the Periodic Report – Colorado requires LLCs to file an Annual Report ($10 fee).

That’s it! Your LLC is good to go.

3. How long does it take to form a Colorado LLC?

Lightning fast! Since Colorado only accepts online filings, your LLC is usually approved immediately. No waiting weeks or months—your business is official in just minutes!

4. Do I need a registered agent for my LLC in Colorado?

Yes! Every LLC in Colorado must have a registered agent—this can be you, a friend, or a professional service. Your agent must have a physical address in Colorado (no P.O. boxes) and be available during business hours to receive important legal documents.

5. Does Colorado have an annual LLC fee?

Yes, but it’s cheap! You’ll need to file a Periodic Report every year, and it only costs $10. Forgetting to file? Late fees start at $50, so set a reminder!

6. Do I need an Operating Agreement for my Colorado LLC?

Technically, no—Colorado doesn’t legally require it. But if you have multiple members in your LLC, an Operating Agreement is a smart move. It outlines ownership, decision-making rules, and what happens if a member leaves. Even if you’re a single-member LLC, having one helps keep your business legally strong.

7. Do I need a business license for my Colorado LLC?

Colorado doesn’t have a statewide business license, but some cities or counties might require one. If you’re selling products, you’ll need a Colorado Sales Tax License from the Colorado Department of Revenue. Always check with your local government to see if any extra permits apply to your business type.

8. Do LLCs in Colorado pay state taxes?

Colorado LLCs don’t pay a separate state LLC tax, but you will need to pay income tax if your LLC makes money. The state income tax rate is a flat 4.4%. If you sell products, you may also have to collect and remit sales tax.

9. Can I be my own registered agent in Colorado?

Yes! As long as you have a Colorado address (no P.O. boxes) and are available during normal business hours, you can be your own registered agent. But if you’d rather keep your address private or don’t want the responsibility, hiring a professional registered agent service is a solid option.

10. Do I need an EIN for my Colorado LLC?

Yes, if your LLC has employees or more than one member. Even if you’re a single-member LLC, it’s a good idea to get an EIN (Employer Identification Number) from the IRS (it’s free!). An EIN makes it easier to open a business bank account, file taxes, and separate your personal and business finances.

11. What’s the difference between an LLC and a Sole Proprietorship in Colorado?

A sole proprietorship is just you running a business under your own name, with no legal separation between you and your business. That means if your business is sued, your personal assets are at risk.

An LLC (Limited Liability Company) gives you legal protection, separating your personal assets from business debts and lawsuits. It’s the smarter choice if you want to protect yourself and grow your business professionally.

12. How do I keep my Colorado LLC in good standing?

Super simple! Just file your Periodic Report every year (it’s due on your LLC’s anniversary month) and pay the $10 fee. Missing the deadline? You’ll get hit with a $50 late fee, and after two months, the state may dissolve your LLC. So, don’t forget!

13. Can I change my Colorado LLC name later?

Yep! You can file a Statement of Amendment online with the Colorado Secretary of State to change your LLC’s name. The filing fee is $25.

14. Can a foreigner start an LLC in Colorado?

Absolutely! You don’t need to be a U.S. citizen or a Colorado resident to form an LLC here. However, you do need a registered agent with a Colorado address and may need an EIN from the IRS if you plan to do business in the U.S.

15. Can I use a PO Box for my Colorado LLC address?

Nope! Colorado requires a physical street address for your business and registered agent. But you can use a virtual office or a registered agent service if you want privacy.

The material on this website is intended for general information purposes only and should not be construed as legal, tax, or financial advice. Laws and regulations vary by jurisdiction and might change over time. It is critical to obtain specialized guidance that fits your individual situation. The opinions presented here are purely those of the writers and should not be considered professional advice. For any legal or tax-related issues, it is best to speak with a certified specialist who can give specialized advice based on your specific circumstances.