Whether you’re launching a consulting firm, a tech startup, or a small local shop, forming an LLC in Washington, DC, is a smart way to protect yourself legally while keeping things simple. But with so many companies offering LLC formation services, how do you know which one to trust? That’s where I come in!

I’ve taken a deep dive into the Best LLC Services in District of Columbia, breaking down their pricing, features, and overall value. Whether you’re looking for the most affordable option, the best customer support, or the fastest filing speed, this guide will help you find the right service for your needs.

Let’s get started!

Top 5 Best LLC Services in the District of Columbia

Here’s a unique and friendly rundown of the Top 5 Best LLC Services in D.C.—because when it comes to forming your business, you want the best in the game.

1. Registered Agents Inc. – The Business Formation Powerhouse

If you’re looking for a professional, no-nonsense LLC formation service that takes care of the essentials without unnecessary upsells, Registered Agents Inc. is your best bet. They offer business formation for $100 plus state fees and throw in a free year of registered agent services—which is a huge win! Their registered agent service costs $200 per year after the first year, but the quality is top-notch. Plus, they offer business tools like domains, email, and phone services at affordable rates. If reliability and professional-grade services are your priority, they’ve got you covered.

2. Northwest Registered Agent – Privacy and Personalized Support

Northwest is all about keeping your information private while providing top-tier customer support. They charge just $39 plus state fees to form your LLC and include a free year of registered agent service. Their customer support is what makes them stand out—they actually answer the phone with real experts, not outsourced call centers. Plus, they scan all legal documents for you, ensuring you never miss an important notice. If you value privacy, premium service, and straightforward pricing, Northwest is a fantastic choice.

3. Bizee (formerly Incfile) – Budget-Friendly with Free LLC Formation

Want to start your D.C. LLC for free? Bizee (formerly Incfile) offers a $0 + state fees LLC formation package, which is a steal. They also include a free year of registered agent service ($119/year after that), lifetime compliance alerts, and an online dashboard to track your filings. Their Standard ($199) and Premium ($299) packages add extras like EIN registration, an operating agreement, and business contract templates. If you’re on a budget but still want a solid service, Bizee is an excellent pick.

4. Doola – Ideal for Non-US Residents & Global Entrepreneurs

If you’re an international entrepreneur looking to set up an LLC in Washington, D.C., Doola makes the process smooth. Their Starter plan costs $297 per year and includes LLC formation, EIN registration, a registered agent, and a virtual business address. Their higher-tier Total Compliance plans include BOI filing, tax filing, and bookkeeping services, making them a full-service solution for foreign founders. If you’re not a U.S. resident and need a company that handles the full process for you, Doola is an excellent choice.

5. ZenBusiness – Free LLC Formation but Watch for Annual Fees

ZenBusiness offers a $0 + state fees package, just like Bizee, but be aware that their services are subscription-based rather than one-time payments. Their Pro plan ($199/year) and Premium plan ($299/year) include extras like an EIN, an operating agreement, and even website services. They’re a solid option if you like an automated, all-in-one business formation service, but just keep in mind that they charge annually for all packages and services.

Which One Should You Pick?

Each of these companies offers something unique, so the best choice depends on your needs:

- Want a pro-level service with solid pricing? 👉 Registered Agents Inc.

- Need stellar customer support and privacy? 👉 Northwest Registered Agent

- Looking for a budget-friendly or free option? 👉 Bizee

- Starting an LLC as a non-U.S. resident? 👉 Doola

- Would you prefer an automated, all-in-one solution (but okay with annual fees)? 👉 ZenBusiness

No matter which one you choose, you’ll be in good hands when forming your Washington, D.C. LLC. 🚀

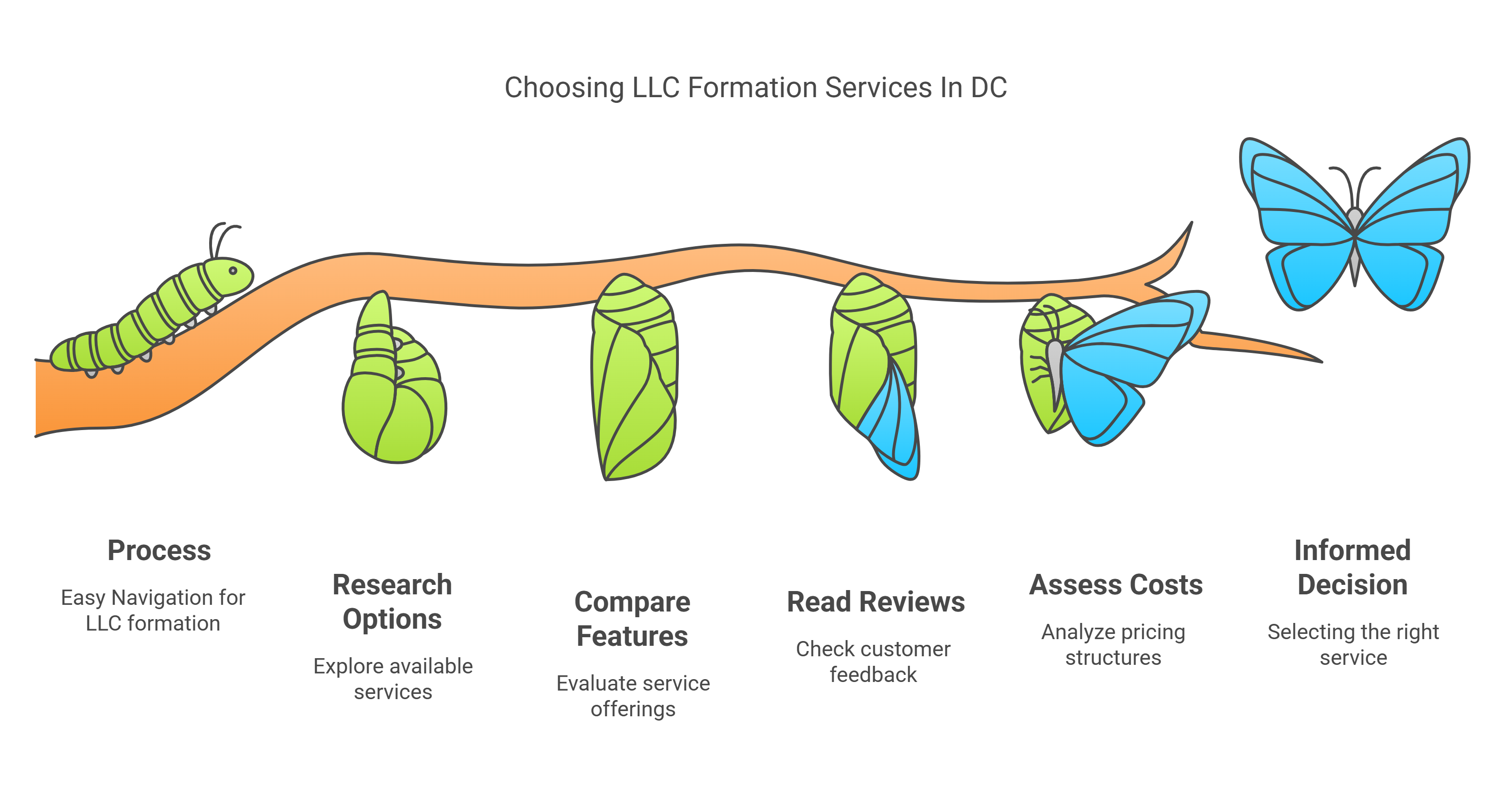

How To Choose the Best LLC Service In the District of Columbia?

Starting an LLC in Washington, D.C., is an exciting step, but let’s be real—navigating the formation process can feel overwhelming. That’s where LLC formation services come in. They handle the heavy lifting so you can focus on building your business. But with so many options out there, how do you pick the right one? Here’s what you need to know to make the best choice.

1. Pricing That Makes Sense

Money matters. Some services charge nothing upfront (just state fees), while others bundle in extra features at a higher cost. Before diving in, compare what’s included in the base price. If all you need is the essentials—filing your Articles of Organization—don’t overpay for unnecessary add-ons. On the flip side, if you need extras like an EIN or an operating agreement, check if they’re included or cost extra.

2. Turnaround Time That Matches Your Timeline

Are you in a hurry to get your LLC up and running, or can you afford to wait a bit? Some services offer expedited filing, while others take their time. If speed is a priority, look for a service that provides faster processing. Just remember—quicker service often comes with an extra fee.

3. Ease of Use Matters

Nobody wants to wrestle with a clunky website or get lost in legal jargon. A good LLC service should have a simple, user-friendly platform that guides you through the process without confusion. If the website feels like a maze, you might want to look elsewhere.

4. Customer Support You Can Count On

At some point, you might have questions. When that happens, you want a reliable support team that’s easy to reach. Some services offer phone, email, or even live chat support. If you prefer speaking to a human instead of waiting for an email response, check their availability and response times before signing up.

5. Transparent Features and No Sneaky Fees

Some LLC services are upfront about costs, while others hit you with surprise charges later. Be sure to read the fine print. If a service offers a “free” formation package, find out if they require an upsell to get essential services like a registered agent or annual compliance reminders.

6. Registered Agent Services

Speaking of registered agents—your LLC needs one to receive legal and tax documents. Some services include this for free for the first year, while others charge extra right away. Look at the ongoing cost after the first year to avoid surprises.

7. Additional Business Tools

Beyond forming your LLC, some services provide helpful business tools like EIN registration, compliance monitoring, domain name registration, and more. If you think you’ll need these down the road, it might be worth choosing a service that offers them as part of a bundle.

8. Reputation and Customer Reviews

Nothing beats firsthand experiences. Before committing, check customer reviews to see what others say. Are people happy with the service? Do they mention hidden fees, poor customer support, or long delays? A little research can save you a lot of frustration.

9. Scalability for Future Needs

Your business might start small, but what about the future? If you think you’ll need additional legal services, compliance help, or even a switch to a corporation down the line, consider choosing a service that offers those options.

My Two Cents!

The best LLC service in Washington, D.C., is the one that fits your specific needs—whether that’s affordability, speed, simplicity, or ongoing business support. Take the time to compare options, read the fine print, and choose a service that will set your LLC up for success without unnecessary headaches.

Now, go forth and build that business!

Reviews of Best LLC Services in the District of Columbia

Still unsure which service you should choose for forming an LLC in the District of Columbia? worry not, Check out in-depth reviews with the pros and cons of Best LLC Services in the District of Columbia.

1. Registered Agents Inc.

Registered Agents Inc. is a lesser-known but highly professional service that specializes in business formations and registered agent services. They are not just another big-box provider—they focus heavily on privacy, reliability, and efficiency.

But how do they stack up for forming a D.C. LLC? Let’s dive in!

What Does Registered Agents Inc. Offer for a D.C. LLC?

Registered Agents Inc. offers a business formation package priced at $100 + D.C. state fees. Here’s what you get:

✅ LLC Formation – They handle the Articles of Organization filing with the D.C. Department of Consumer and Regulatory Affairs (DCRA).

✅ Registered Agent Service (1st Year Free) – They’ll serve as your registered agent for free the first year. After that, it’s $200 per year.

✅ Business Address – If privacy matters, they keep your home address off public records.

✅ Compliance Support – They ensure your business stays in good standing with reminders and compliance tools.

Pros of Using Registered Agents Inc. for a D.C. LLC

✅ Flat Pricing – No Hidden Upsells

Unlike some big-name LLC services that start cheap but pile on the add-ons, Registered Agents Inc. charges a straightforward $100 for formation.

✅ Free First-Year Registered Agent Service

This is a great value, considering D.C. requires all LLCs to have a registered agent with a physical address in the district.

✅ Privacy Protection

If you don’t want your personal address plastered on D.C.’s public business database, Registered Agents Inc. keeps it off the record.

✅ Specialized in Registered Agent Services

Many formation companies outsource registered agent duties—but this company actually specializes in it. If reliability and professionalism matter, they excel here.

✅ Business Essentials for Cheap

They offer a business domain name for just $5 per year and website, email, and phone services at $5 per month each. That’s a great deal for anyone needing an online presence.

Cons of Using Registered Agents Inc. for a D.C. LLC

❌ No Free LLC Formation Option

Some competitors like ZenBusiness or Bizee offer a $0 + state fees LLC formation package, while Registered Agents Inc. charges $100 + state fees.

❌ More Expensive Registered Agent Renewal ($200/Year)

While the first year is free, their $200/year registered agent fee is pricier than some competitors like Northwest Registered Agent ($125/year).

❌ No EIN Filing Included

If you need an EIN for your business, you’ll have to apply through the IRS yourself or pay extra for third-party services.

Should You Use Registered Agents Inc. for a D.C. LLC?

If you want a reliable, private, and professional service that specializes in business formation and compliance, Registered Agents Inc. is a solid choice.

However, if you’re looking for the absolute cheapest option, you might find other services that offer free formations (with paid add-ons).

Best For:

✅ Business owners who want a private and secure registered agent.

✅ People who prefer simple, no-nonsense pricing.

✅ Entrepreneurs who need additional business essentials like domain, email, and phone services.

Not Ideal For:

❌ Those looking for a completely free LLC formation service.

❌ Anyone who wants an EIN included in the package.

Final Verdict

Registered Agents Inc. isn’t the most well-known formation service, but they are reliable, professional, and don’t play games with pricing. If you value privacy, a solid registered agent, and no unnecessary upsells, they’re worth considering for your D.C. LLC.

Start Your Business Today with Registered Agents Inc.

2. Northwest Registered Agent

Wondering if Northwest Registered Agent is the right choice. Well, let’s break it all down in a way that makes sense—no legal jargon, just straight-up facts with a friendly touch.

Why Consider Northwest for Your D.C. LLC?

Northwest Registered Agent has a solid reputation for privacy, great customer service, and no upsells—which is a rarity in the business formation world. Plus, they’ve been around since 1998, so they know what they’re doing. But is it the right fit for your D.C. LLC?

The Pros of Using Northwest for a D.C. LLC

✅ Flat and Transparent Pricing

Northwest charges $39 plus D.C.’s state fee for LLC formation, which is pretty affordable. No sneaky upsells, no confusing add-ons—just straightforward pricing.

✅ Registered Agent Service Is Free for the First Year

Since every D.C. LLC is legally required to have a registered agent, you’d need one anyway. Northwest includes one year of registered agent service for free, and after that, it’s $125 per year—which is a solid deal.

✅ Premium Customer Support (No Call Centers!)

One of the standout features of Northwest is their U.S.-based customer support team. Unlike some competitors that send you through an endless loop of automated messages, you get a real human (called a “Corporate Guide”) who actually knows what they’re talking about.

✅ Privacy Protection (They Don’t Sell Your Data!)

A lot of business formation companies sell your personal info to third-party marketers (cough LegalZoom cough), but Northwest doesn’t do that. If privacy matters to you, this is a major plus.

✅ Same-Day Filing for Washington, D.C. LLCs

If you file through Northwest, they submit your LLC formation the same day. Since D.C. processes online filings within 5-10 business days (or even faster with expedited options), this means you get your LLC set up without unnecessary delays.

✅ Local Expertise in D.C. Compliance

Washington, D.C. has some unique LLC compliance rules, including:

- An initial report due within six months of formation.

- A $300 biennial report (every two years).

- Business license requirements from the Department of Consumer and Regulatory Affairs (DCRA).

Northwest stays on top of these requirements and sends compliance reminders so you don’t miss any deadlines.

The Cons of Using Northwest for a D.C. LLC

❌ Not the Cheapest Option

While $39 plus state fees is a great deal, some competitors (like Bizee, formerly Incfile) offer free LLC formation—though they don’t provide the same level of service. If you’re on a super tight budget, you might consider a free option instead.

❌ Registered Agent Renewal Is More Expensive Than Some Competitors

After the first free year, Northwest’s registered agent service costs $125 per year, which is higher than some competitors (like Bizee, which charges $119/year). However, Northwest doesn’t sell your data, so you’re paying for privacy and quality.

❌ No Free EIN

Some LLC formation services include a free EIN (Employer Identification Number) with their higher-tier packages. Northwest doesn’t offer this for free—they charge $50 to obtain it for you. That said, you can easily get an EIN yourself for free from the IRS website in about 10 minutes.

❌ Limited Additional Services

If you need extras like bookkeeping, accounting, or business tax services, Northwest doesn’t offer them. They focus on business formations and registered agent services—nothing more, nothing less.

Final Verdict: Is Northwest Right for Your D.C. LLC?

If you want top-tier customer service, privacy, and simple pricing, then Northwest Registered Agent is a fantastic choice for forming your LLC in Washington, D.C. Their $39 formation price, same-day filings, and free registered agent service for the first year make them a strong option.

However, if you’re looking for the absolute cheapest option or need a business formation service that includes extra perks like a free EIN, you might want to compare other providers.

Best For:

✔️ Entrepreneurs who value privacy and high-quality customer service.

✔️ Business owners who want a reliable, straightforward experience without constant upsell.

✔️ Those who don’t mind paying a bit more for premium service.

Not Ideal For:

❌ People who want the absolute cheapest LLC formation.

❌ Those who prefer a free EIN are included with their package.

❌ Business owners who need full-service bookkeeping and tax assistance.

At the end of the day, Northwest is one of the best LLC formation services out there, especially if you care about privacy and personalized support. If that sounds like your kind of thing, they’re definitely worth considering for your Washington, D.C. LLC! 🚀

Are you ready? Form Your LLC Now with Northwest Registered Agent

3. Bizee

If you’re thinking about starting an LLC in the District of Columbia, you’ve probably come across Bizee (previously known as Incfile). With its $0 LLC formation package (plus state fees), it’s one of the most affordable options. But is it the right choice for a DC-based LLC? Let’s dive into the pros, cons, and overall experience of using Bizee for your District of Columbia LLC.

Quick Overview of Bizee

Bizee is a budget-friendly LLC formation service that’s been around since 2004. They’re best known for their free LLC formation (excluding state fees), a year of free registered agent service, and lifetime company compliance alerts.

If you’re forming an LLC in District of Columbia, the state fee is $99, and Bizee lets you form your LLC for just that amount—no extra service fees if you pick their basic package.

Pros of Using Bizee for a District of Columbia LLC

✅ $0 LLC Formation + State Fees – The biggest perk! You only pay $99 to District of Columbia, and Bizee handles the LLC filing at no extra cost.

✅ Free Registered Agent for One Year – DC requires a registered agent, and Bizee gives you one free for the first year (then it’s $119 per year if you keep using them).

✅ Fast Online Filing – Bizee makes the process super easy and online-friendly. Just enter your details, pay the state fee, and they handle the rest.

✅ Lifetime Compliance Alerts – They notify you about important deadlines, like District of Columbia’s biennial report (due every two years with a $300 filing fee).

✅ Great for Budget-Conscious Entrepreneurs – If you just need basic LLC formation, Bizee gets the job done without unnecessary upsells.

✅ Easy Dashboard for Business Management – They provide an online dashboard where you can track documents, check deadlines, and manage your LLC.

Cons of Using Bizee for a District of Columbia LLC

❌ Upsells & Add-Ons Can Get Pricey – While the basic package is free, add-ons like an EIN ($70) or an Operating Agreement ($40) cost extra.

❌ Customer Support Isn’t Always Great – Some users report slow response times, especially via email. Phone support is available but may have long wait times.

❌ Registered Agent Fee After Year One – After the first year, Bizee charges $119 per year for registered agent service. While not the most expensive, some other services charge less.

❌ No DC-Specific Filing Expedite Option – The District of Columbia doesn’t have the fastest LLC approval times (usually 5 to 10 business days), and Bizee doesn’t offer a state-specific expedite option like some competitors.

Bizee Pricing for a District of Columbia LLC

Bizee offers three packages:

1️⃣ Basic Package ($0 + $99 state fee)

- Articles of Organization filing

- Free registered agent for one year

- Lifetime compliance alerts

- Online dashboard access

2️⃣ Standard Package ($199 + $99 state fee)

- Everything in Basic

- EIN (Tax ID)

- Operating Agreement

- Banking resolution

- IRS Form 2553 (for S-Corp election)

3️⃣ Premium Package ($299 + $99 state fee)

- Everything in Standard

- Expedited filing

- Business contract templates

- Domain name and email

For most District of Columbia entrepreneurs, the Basic package ($0 + state fee) is a great deal, and you can always add an EIN separately for free through the IRS instead of paying Bizee for it.

Is Bizee a Good Choice for a District of Columbia LLC?

If you want an affordable and simple LLC formation service, Bizee is one of the best choices for a District of Columbia LLC. Their $0 formation cost (plus state fees) and free registered agent for a year make them a solid pick.

However, if you need fast filing or top-tier customer support, you might want to explore other options. That said, if you’re comfortable handling small business tasks like getting your own EIN, Bizee offers great value.

Final Verdict

✔ Best for entrepreneurs who want a free, no-frills LLC filing.

✖ Not ideal if you need premium support or faster filing options.

Form your LLC Now with BIzee

4. Doola

Wondering if Doola is the right choice. I’ve done the research, and I’m here to break it all down for you in a clear, friendly, and no-fluff way. Let’s go over the pros, cons, and pricing so you can make the best decision.

What Is Doola?

Doola is an online service that helps entrepreneurs (especially non-US residents) form an LLC in the United States. They handle everything from LLC formation, EIN acquisition, registered agent services, and compliance filings—basically, all the paperwork so you don’t have to stress about it.

Doola’s Packages & Pricing for District of Columbia LLC

Doola offers three service tiers:

- Starter – $297/year (+ state fees)

- District of Columbia LLC formation

- EIN (Employer Identification Number)

- Registered agent service

- Virtual business address

- Total Compliance – $1,999/year (+ state fees)

- Everything in the Starter package

- BOI (Beneficial Ownership Information) filing

- Biennial report filing

- 1:1 CPA tax consultation

- Business IRS tax filings

- Total Compliance Max – $2,999/year (+ state fees)

- Everything in the Total Compliance package

- Human-powered bookkeeping services

👉 District of Columbia State Fees:

- LLC Formation Fee: $99 (one-time)

- Biennial Report Fee: $300 (due every two years)

Note: District of Columbia may require additional business licensing, depending on your industry.

Pros of Using Doola for a District of Columbia LLC

✅ All-in-One Service – Doola simplifies the LLC formation process by handling the legal paperwork, EIN, and compliance services for you.

✅ Great for Non-US Residents – If you’re not based in the U.S., Doola is one of the best options because they assist with the EIN application, which can be tricky for foreigners.

✅ Includes a Virtual Business Address – District of Columbia requires a physical address, and Doola provides a virtual address (which many competitors don’t).

✅ BOI Filing Support – The new Beneficial Ownership Information (BOI) reporting can be confusing, but Doola’s Total Compliance packages take care of it.

✅ Business Tax Filing & CPA Support – Their higher-tier plans provide tax consultation and IRS business tax filings, which are useful if you don’t want to deal with taxes yourself.

✅ No Hidden Fees – Unlike some competitors that charge extra for an EIN, Doola includes it in all plans.

✅ User-Friendly Dashboard – Doola provides an easy-to-use online platform to track your LLC status, tax filings, and compliance deadlines.

Cons of Using Doola for a District of Columbia LLC

❌ Expensive Compared to Competitors – At $297/year, Doola is pricier than some other LLC services like ZenBusiness ($0 + state fees) or Bizee ($0 + state fees).

❌ Annual Subscription Model – You have to pay every year for their services. Some other companies charge a one-time fee for LLC formation.

❌ Registered Agent Renewal is Costly – After the first year, the registered agent service isn’t free—you’ll have to renew it annually.

❌ Not Ideal for DIY Entrepreneurs – If you’re comfortable filing your own EIN and LLC paperwork, you don’t need Doola’s high-priced plans. You can form a District of Columbia LLC yourself for $99 and get a free EIN from the IRS.

Is Doola Worth It for a District of Columbia LLC?

👉 If you’re a non-US resident or just want an all-in-one service, Doola is a great option. They handle all the complicated stuff—EIN, registered agent, virtual address, compliance—so you don’t have to.

👉 If you’re on a budget, you might want to explore other options. District of Columbia is already an expensive place to run an LLC ($99 formation + $300 biennial report). If you don’t need extra services like tax filing, you could save money by choosing a cheaper LLC provider.

Final Verdict

✅ Best for: Non-US entrepreneurs, busy business owners, and those who want everything handled for them.

❌ Not ideal for: DIYers, budget-conscious entrepreneurs, and those who prefer one-time fees over annual subscriptions.

I have partnered with them and Have an exclusive 10 percent Discount code for my readers: DOOLAREHAN10

5. Zenbusiness

If you’re looking to start an LLC in Washington, D.C., ZenBusiness might be one of the first services you come across. They’re well-known for their affordable formation packages, automated compliance features, and user-friendly dashboards. But is ZenBusiness really the best choice for forming a D.C. LLC? Let’s break it down in a way that’s easy to digest.

The Good Stuff: Pros of Using ZenBusiness for a D.C. LLC ✅

1. Affordable LLC Formation ($0 + State Fees)

One of ZenBusiness’s biggest perks is its free basic LLC formation package (you only pay the Washington, D.C. state fee). Compared to other services that charge right off the bat, this is a solid deal. However, keep in mind that ZenBusiness makes money through upsells and annual subscriptions (we’ll talk about that in the cons).

2. Automated Compliance Tools

ZenBusiness offers compliance reminders and filing services, which can be super helpful in D.C. (Annual reports and biennial reports are required!) If you don’t want to stress about deadlines, their Worry-Free Compliance service ($199/year) could save you from late fees and penalties.

3. User-Friendly Dashboard

If you like a clean, modern interface, ZenBusiness delivers. Their online dashboard makes it easy to track your LLC’s status, access documents, and stay organized. No confusing menus—just a simple, smooth experience.

4. Fast and Reliable Filing

ZenBusiness is known for quick processing times. If you’re in a hurry, they offer expedited and rush filing options (for an extra fee). In Washington, D.C., LLC filings can take up to 15 business days, but with ZenBusiness’s expedited options, you can get it done much faster.

5. Positive Customer Reviews

ZenBusiness has thousands of great reviews from happy customers. People love their affordability and ease of use. Plus, their support team—while not the fastest—does get positive feedback for being helpful when they do respond.

The Not-So-Great Stuff: Cons of Using ZenBusiness for a D.C. LLC ❌

1. Annual Fees for Everything

While the $0 formation deal sounds great, many ZenBusiness services are billed annually, not as a one-time fee. For example:

- Worry-Free Compliance ($199/year)

- Registered Agent Service ($199/year after the first free year)

- Operating Agreement Template (only included in Pro and Premium plans)

If you don’t cancel unwanted services, these annual fees can add up fast.

2. Expensive Registered Agent Service

Every D.C. LLC needs a registered agent (someone to receive legal notices for your business). While ZenBusiness includes the first year for free, they charge $199 per year after that. There are cheaper options out there, including Northwest Registered Agent, which charges $125/year.

3. Customer Support Could Be Better

ZenBusiness’s support isn’t 24/7, and response times can be slow. If you run into an issue, you may have to wait a while for help. For some people, that’s a dealbreaker—especially if you’re forming an LLC on a tight deadline.

4. Limited Customization in the Basic Plan

The Starter Plan ($0 + state fees) is barebones. It doesn’t include an EIN, an operating agreement, or expedited filing. If you need these extras, you’ll have to upgrade to the Pro plan ($199/year) or purchase them separately.

ZenBusiness Pricing for a D.C. LLC

Here’s a quick look at ZenBusiness’s packages:

- Starter: $0 + D.C. State Fees ($99)

- Basic LLC filing

- Name availability search

- Paid annual add-ons for compliance & registered agent

- Pro: $199/year + State Fees

- Includes Starter features

- EIN acquisition

- Operating Agreement

- Worry-Free Compliance

- Premium: $299/year + State Fees

- Includes Pro features

- Business website, email, domain name

- Faster filing speeds

Final Verdict: Is ZenBusiness Worth It for a D.C. LLC?

ZenBusiness is a solid choice for forming a Washington, D.C. LLC—if you’re okay with annual fees. Their basic filing option is free (which is great!), but you’ll need to watch out for upsells and recurring charges.

If you want an all-in-one service with compliance tools and a user-friendly dashboard, ZenBusiness is a good fit. But if you’re looking for a one-time fee option or a cheaper registered agent, you might want to compare it to other services like Northwest or Bizee (formerly Incfile).

Would I recommend ZenBusiness for a D.C. LLC? Yes, but with caution—know what you’re signing up for and be ready to cancel any services you don’t need. 🚀

Start an LLC today with Zenbusiness

Conclusion: Best LLC Services in the District of Columbia

Starting an LLC in Washington, D.C., is an exciting step toward building your business, and choosing the right service to help with the process can make all the difference. Whether you need a simple filing option or a more comprehensive package with extra support, there’s a solution out there that fits your needs.

At the end of the day, the best LLC service is the one that makes your life easier—offering clear pricing, reliable customer support, and the tools to keep your business compliant. So take your time, compare your options, and pick a service that aligns with your budget and business goals. With the right choice, you’ll be well on your way to running a successful LLC in the heart of the nation’s capital.

Now go out there and build something great! 🚀

Best LLC Services in District of Columbia FAQs

I have answered the most asked questions by you here.

Rehan, LegalZoom is a big name in the world of LLC Formation why do you hate them?

Hate is a strong word, but let’s just say I wouldn’t rush to LegalZoom’s front door with a bouquet of flowers and a thank-you card. Here’s the deal—LegalZoom is like that fancy-looking restaurant on the corner that everyone talks about, but when you actually sit down to eat, you realize the portions are tiny, the service is slow, and they charge you extra for water.

LegalZoom sounds like a safe and easy choice because it’s a big brand. They’ve got the name recognition, the marketing muscle, and years in the business. But when you dig a little deeper, you start to see the cracks:

- Overpriced for What You Get – LegalZoom isn’t just expensive; they nickel-and-dime you on things that other services include for free (like an operating agreement). Their cheapest LLC package ($0 + state fees) might look affordable, but if you actually need essentials like an EIN or an operating agreement, suddenly you’re paying way more than you would elsewhere.

- Slow Filing Times – If patience isn’t your strong suit, you’re in for a rough ride. While some LLC formation services process filings quickly, LegalZoom drags its feet unless you pay extra for “rush” filing. Some users have reported waiting weeks just for paperwork to get started.

- Endless Upsells – LegalZoom is like that pushy salesperson who won’t let you browse in peace. They constantly upsell you on services you might not even need, like ongoing compliance help or unnecessary legal add-ons. By the time you’re done, you might be spending hundreds more than you expected.

- Not the Best Customer Support – You’d think a company as big as LegalZoom would have top-notch support, but nope. Their customer service is hit-or-miss, with long wait times and reps who don’t always have clear answers. If you ever need help, good luck getting a quick and useful response.

- Annual Fees for Services That Should Be One-Time – LegalZoom loves recurring charges. Want them as your registered agent? That’s $249 per year, even though other companies do it for $100-$150. Need compliance help? That’s another ongoing fee. They lock you into expensive renewals before you even realize it.

At the end of the day, I’m all about value—getting the most bang for your buck. LegalZoom? Not so much. There are better, faster, and cheaper LLC formation services out there that don’t treat you like an ATM.

So, it’s not that I hate LegalZoom. I just think people deserve to know the full story before they get lured in by a big name. If you like overpaying and waiting longer than necessary, go for it. But if you want a smoother, more affordable experience, there are better options out there.

Is a registered agent required for DC LLC?

Yes! If you’re forming an LLC in Washington, D.C., you must have a registered agent. There’s no way around it—it’s a legal requirement.

Think of a registered agent as your LLC’s official point of contact for government notices, legal documents, and all the boring (but important) paperwork. Whether it’s a lawsuit (hopefully not!) or a reminder about annual filings, your registered agent makes sure you get the message.

You can either:

- Be your own registered agent (if you have a physical address in D.C. and are available during business hours).

- Hire a professional registered agent service (which can be a great option for privacy and convenience).

Skipping this step? Not an option—D.C. won’t approve your LLC without one. So, make sure you’ve got a solid registered agent in place before you file! 🚀

Can I get DC LLC for free?

Ah, the dream—starting an LLC in Washington, D.C., for free. If only the government shared that dream! But unfortunately, that’s not the case.

Washington, D.C., requires a $99 filing fee to register an LLC. That’s just for the Articles of Organization, the document that officially creates your LLC. No free ride here!

Now, you might have seen some business formation companies offering “free LLC formation.” Here’s the catch: They’re waiving their service fee, but you still have to pay the $99 state fee. Plus, they might try to upsell you on other services, so watch out for that.

And don’t forget—D.C. has an extra $300 biennial report fee (due every two years), plus a $220 Basic Business License for most businesses. So while starting an LLC here isn’t outrageously expensive, it’s definitely not free.

If you’re looking for ways to save money, you can always DIY the filing instead of using a formation service. Just go straight to the D.C. Department of Consumer and Regulatory Affairs (DCRA) website and file it yourself. It takes a little more effort, but you’ll avoid any extra fees from third-party services.

So, free? Nope. But with some strategic planning, you can keep your costs as low as possible.

Is the District of Columbia a good state to form an LLC?

The District of Columbia might seem like a cool place to form an LLC—after all, it’s home to the nation’s capital, rich history, and plenty of business opportunities. But is it actually a good place to start your LLC? Well, let’s break it down in a friendly and realistic way so you can decide whether DC is the right fit for your business.

Pros of Forming an LLC in DC

🌟 Prime Location & Networking

DC is a business hotspot, especially if you’re in government contracting, lobbying, law, or consulting. If your business revolves around working with the federal government or related industries, being based in DC can give you credibility and access to decision-makers.

💼 No State-Level Income Tax for LLCs

Unlike many states, DC doesn’t have a separate state-level personal income tax for LLC owners. However, you still have to deal with federal taxes and some local business taxes (more on that in the cons 👇).

🚀 Access to Funding & Resources

DC has tons of grants, incubators, and business development programs, especially for minority-owned, women-owned, and veteran-owned businesses. If you’re looking for funding or mentorship, DC might be a great place to tap into these resources.

🏛️ Strong Legal Protections

LLCs in DC benefit from solid business laws that provide liability protection and flexibility in management.

Cons of Forming an LLC in DC

🏛️ Expensive Business Taxes

DC is notorious for its business-friendly image but not-so-friendly tax structure. Here’s what you need to watch out for:

- Franchise Tax – LLCs in DC must pay an Unincorporated Business Franchise Tax (UBT), which is 8.25% of net income if you make more than $12,000. Many states don’t even have this!

- Minimum Tax Requirement – Even if your LLC makes little or no money, you still owe at least $250 (for under $1M revenue) or $1,000 (for over $1M revenue) annually in franchise taxes.

- Personal Property Tax – If your business owns equipment, furniture, or other assets worth over $225,000, you’ll owe property tax on them.

📑 Annual Costs & Paperwork

- The LLC filing fee in DC is $99 (not terrible, but not the cheapest either).

- You must file a biennial report (every two years), which costs $300—pretty pricey compared to other states.

- If you don’t file the report on time, DC slaps you with a $100 late fee, plus you risk administrative dissolution.

🚦 Regulations & Bureaucracy

DC is known for strict business regulations and red tape. Depending on your industry, you may need extra licenses and permits beyond the usual LLC formation.

🏙️ High Cost of Living

If you plan to operate in DC, keep in mind that rent, wages, and general expenses are higher than the national average. If you’re just starting out or running a small online business, this could cut into your profits.

So, Is DC a Good Place for an LLC?

It depends on your business!

✔️ DC is great if…

- You work in government contracting, consulting, law, or lobbying.

- You want to network and be close to policymakers and decision-makers.

- You plan to take advantage of local funding, grants, or business programs.

❌ DC might not be the best if…

- You want to avoid high taxes and fees.

- You’re running a small, online, or side business with minimal local presence.

- You want a state with less red tape and lower costs.

Alternative Option

If you live in DC but want to avoid high fees, many entrepreneurs form an LLC in Virginia or Maryland instead. Both are nearby, more affordable and don’t have DC’s franchise tax.

Final Verdict: Think Before You File!

DC has a unique business environment, but it’s not the most cost-effective choice for every LLC. If your business thrives on being in the heart of the action (politics, government work, or high-level networking), it might be worth it. Otherwise, you might be better off forming your LLC in a lower-cost state while still operating in DC.